Shipments of mechanical hard drives are steadily declining, confirming what everyone in the industry knew already – the PC market is losing steam.

Shipments of mechanical hard drives are steadily declining, confirming what everyone in the industry knew already – the PC market is losing steam.

Seagate saw its Q2 shipments drop 3.2 percent over Q1, to 53.9 million drives. Toshiba lost some market share and shipped 19.6 million units. Western Digital shipped 59.9 million drives, 0.4 percent less than in Q1.

Shipments of mobile drives were also down 0.4 percent and the average drive size remained at 610GB. Hybrid drives are not taking off as expected by some punters.

Desktops fared even worse, with an 8.3 percent decline from the first quarter. The slump may cause some inventory concerns in Q3 and beyond. The average capacity of desktop drives shipped last quarter was 1TB, no changes there.

There is some good news to report as well. The enterprise hard drive market is recovering. It was up 12 percent last quarter. Shipments of hard drives for consumer electronics were also up, 0.8 percent according to IT Wire.

Although there’s plenty of room for improvement, the hard drive market won’t recover anytime soon.

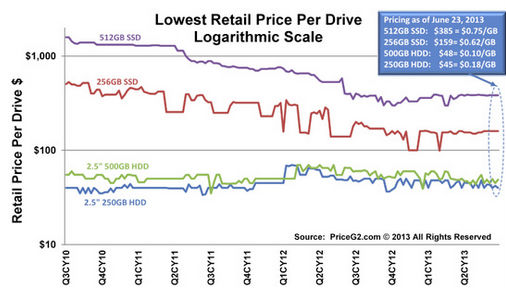

Cheaper SSDs and hybrid drives are also starting to make a mark, but HDDs are still the cheapest option and the darling of OEMs and consumers alike.