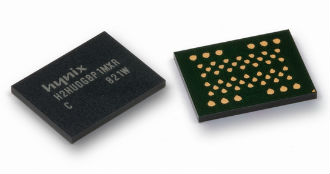

Memory and storage outfit Micron has announced its new technology enablement programme (TEP), which will provide customers with early access to technical resources and products, including DDR5 DRAM.

Memory and storage outfit Micron has announced its new technology enablement programme (TEP), which will provide customers with early access to technical resources and products, including DDR5 DRAM.

Micron said that the programme has been designed to help with the design, development and qualification of next-generation computing platforms that use DDR5.

Qualified partners such as Cadence, Montage, Renesas and Synopsys, will be able to get their paws on DDR5 components and modules, new DDR5 products as they become available and technical resources.