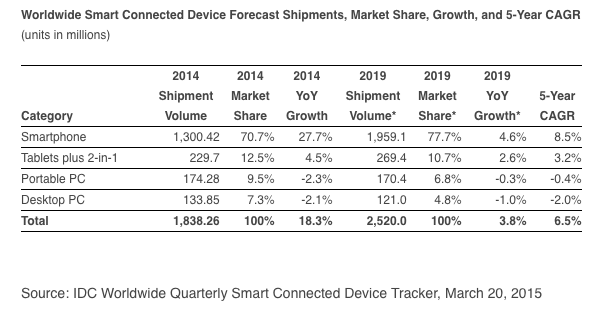

The global PC market saw a year on year rise of 53.1 percent with 122.1 million units shipped, according to research from Canalys.

The global PC market saw a year on year rise of 53.1 percent with 122.1 million units shipped, according to research from Canalys.

Chromebook sales in the education sector boosted the PC market during the first quarter of 2021 and while the education sector accounted for the majority of shipments, their popularity with consumers and traditional commercial customers reached new heights over the course of the last year.

Tablets closely followed as one of the key growth drivers, logging an increase in sales of 51.8 percent and shipment volumes of 39.7 million units.

Canalys research analyst, Brian Lynch said HP and Lenovo dominate the Chromebook market, but Acer and Samsung carved out substantial shares within the PC market by providing Chromebooks.