Chipmaker AMD is relying more on its partners to come up with the latest R&D ideas, just like it did in the 1990s.

Chipmaker AMD is relying more on its partners to come up with the latest R&D ideas, just like it did in the 1990s.

Decrypted tech claims that over the past few years AMD has been slowly cutting back on the money it puts towards R&D.

Instead it has tried to narrow the focus of the money they spend on new technology where it thinks it will get the most return. So in the last quarter AMD spent less than $238 Million on R&D and his been building R&D partnerships to overcome budget challenges.

AMD started rebuilding its R&D partnerships in late 2010 and this allowed it to cut back on the amount they need to bring to the table to create new technologies. This is a repeat of what it did in the 1990s when the outfit used Samsung, IBM, Motorola, and Texas Instruments helping them to change the way they built CPUs.

This was how it could build the Athlon CPU with only a small R&D budget and engineering team.

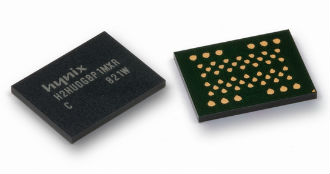

This time AMD is betting big on HBM and also on integrating ARM processors inside their APU/CPUs and apparently it is letting its R&D partners do a lot of the heavy lifting money-wise while they provide many of the engineering minds.

If it pays off, AMD gets its technology on the cheap. However in the worst case it could hack off some big names in the in the industry like Hynix, Samsung, Toshiba etc. and walk away with new technology to sell to others.

The plan is high risk as it could leave AMD with nothing it can sell, while its partners have some natty tech that AMD helped them build.