A report said that Taiwanese original design manufacturer (ODM) Quanta will supply search engine giant Google with its servers in 2015.

A report said that Taiwanese original design manufacturer (ODM) Quanta will supply search engine giant Google with its servers in 2015.

Google has long abandoned the habit of using “brand name” servers from the likes of Dell, HP or IBM/Lenovo.

The news, reported in Digitimes, confirms a recent survey saying that the ODMs, which often build machines that are then subsequently branded, are taking market share from the brand names.

It’s not just Google that is following this path. Amazon, Facebook and Microsoft also buy their servers direct. Quanta has benefited more from these changes in buying patterns because it has been quicker to realise the money involved than rivals such as Taiwanese company Inventec.

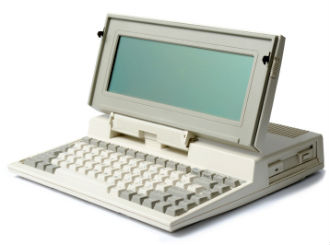

Until comparatively recently, Quanta’s entire business was building notebook machines, subsequently branded by others. But the bottom has somewhat fallen out of the notebook business with the rise of tablets and smartphones.