Consumers and carriers are slowly but surely transitioning to 4G and the hunger for high speed broadband on the go is transforming the way we use our clever mobile devices, including traditional kit like notebooks. Earlier this week Samsung announced its first 5G milestone, proudly telling the world that 1Gbps 5G is coming by 2020.

Consumers and carriers are slowly but surely transitioning to 4G and the hunger for high speed broadband on the go is transforming the way we use our clever mobile devices, including traditional kit like notebooks. Earlier this week Samsung announced its first 5G milestone, proudly telling the world that 1Gbps 5G is coming by 2020.

Author: Eva Glass

Handset sales up, Samsung gains share

Smartphone wars are becoming rather predictable. Every quarter sales notch up and every quarter Samsung emerges as the big winner. The last quarter was no exception. However, growth is slowing as the market matures, although there is still plenty of room for growth in emerging markets.

Smartphone wars are becoming rather predictable. Every quarter sales notch up and every quarter Samsung emerges as the big winner. The last quarter was no exception. However, growth is slowing as the market matures, although there is still plenty of room for growth in emerging markets.

Worldwide phone sales totalled 426 million units in the first quarter, up 0.7 percent year-on-year. Smartphones saw a lot more growth, with sales totalling 2010 million units, up 42.9 percent from a year ago, according to a Gartner survey.

Sales of feature phones are down in all regions except Asia, while smartphones accounted for 49.3 percent of all phone sales worldwide, up from 34.8 percent in Q1 2012. At the same time feature phone sales contracted 21.8 percent.

“Feature phones users across the world are either finding their existing phones good enough or are waiting for smartphones prices to drop further, either way the prospect of longer replacement cycles is certainly not good news for both vendors and carriers looking to move users forward,” Gartner analyst Anshul Gupta said.

Samsung saw its market share go up from 21.1 percent to 23.6 percent. Apple also did well, growing from 7.8 to 9 percent, while Nokia’s share dropped from 19.7 to 14.8 percent. However, looking at smartphone sales, Samsung’s share was 30.8 percent, up from 27.6 percent. It was trailed by Apple at 18.2 percent, down from 22.5 percent. LG grabbed the bronze, with a 4.8 percent share. Huawei also had a good quarter, upping their share to 4.4 and 3.8 percent respectively and outperforming former heavyweights like Nokia, Sony and HTC.

Android is still the dominant mobile operating system, with a share of 74.4 percent, up from 56.9 a year earlier. Apple’s iOS share stands at 18.2 percent, down from 22.5 percent a year ago. Just so it wouldn’t look like a two-horse race, Blackberry is still in the game with a 3 percent share, down from 6.8 percent last year. Apparently BB10 did not make a huge difference. Windows Phone has a 2.9 percent share, up from 1.9 percent last year. It is growing, but at a painfully slow rate.

Smartphones improve in-store shopping experience

Although mobile commerce is still experiencing teething problems in most markets, a growing number of consumers are turning to smartphones to improve their shopping experience. Even when they are not making actual transactions, they are using their smartphones to learn more about products and services.

Although mobile commerce is still experiencing teething problems in most markets, a growing number of consumers are turning to smartphones to improve their shopping experience. Even when they are not making actual transactions, they are using their smartphones to learn more about products and services.

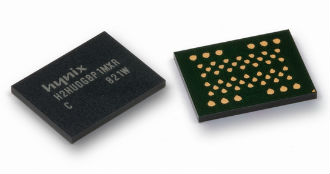

DRAM shortage to last through 2013

The DRAM supply shortage isn’t getting better and memory maker Inotera now believes it will drag on until the end of the year. Strong demand for smartphones and tablets is to blame, and prices are going up as well.

The DRAM supply shortage isn’t getting better and memory maker Inotera now believes it will drag on until the end of the year. Strong demand for smartphones and tablets is to blame, and prices are going up as well.

Inotera believes the drought could even extend into the next year. The average price of benchmark DDR3 4GB modules already rose 13 percent last month according to DRAMeXchange. In fact, the price of DDR3 4GB DRAM has already gone up by about 70 percent in 2013, reports Taipei Times.

DRAMeXchange said demand for DRAM is starting to pick up, reversing an extended period of oversupply. However, the shortage is not bad news for memory makers.

Inotera is hoping to do much better in the second quarter than in the first quarter, in which it managed to narrow its net loss. Memory maker Nanya was profitable in the first quarter and it is reporting that its average selling prices for Q1 rose 30.5 compared from the fourth quarter.

Although the PC slowdown did not help memory makers, phones, tablets and next-gen gaming consoles should help drive demand up and mitigate oversupply issues.

Google ditches physical card

Google is planning to revamp its Google Wallet digital payments platform at Google I/O. However, it seems plans for a physical credit card have been shelved, at least for the time being.

Google is planning to revamp its Google Wallet digital payments platform at Google I/O. However, it seems plans for a physical credit card have been shelved, at least for the time being.

According to AllThingsD, Google informed its staff that the card was ditched in a memo circulated after Google Wallet head Osama Bedier announced he is leaving the company.

However, although the card is history, Wallet is about to get a small revamp. Google will announce a number of changes at I/O, including an update to its rewards programme, more offers and loyalty points, along with the addition of more merchants.

Without a physical card though, Google Wallet will still rely solely on NFC technology, which hasn’t taken off yet. It was hoped that a proper card could push Google Wallet to the next level, but now it seems Google is rethinking its approach. Google doesn’t want to become a bank, or the next Visa. It wants to coexist with existing players and tap their vast infrastructure.

On the gossipy side, sources told AllThingsD’s Liz Gannes that Google CEO Larry Page pulled the plug on the card launch after he witnessed a glitchy demo last week. Apparently Page had long been sceptical of a physical card and the buggy demo was the last straw.

Windows 8 gear set to get cheaper

The PC market is in the middle of its worst slump ever, but there might be some light at the end of the tunnel. PC makers believe prices of Windows 8 devices will fall dramatically in the not so distant future.

The PC market is in the middle of its worst slump ever, but there might be some light at the end of the tunnel. PC makers believe prices of Windows 8 devices will fall dramatically in the not so distant future.

On Wednesday Acer President Jim Wong said Microsoft is becoming increasingly considerate to its hardware partners and that it is finally starting to listen to their suggestions and ideas. Shifting the focus to cheaper products seems to have been the loudest suggestion. Wong also pointed out that touch enabled devices will open up a lot of possibilities for PCs, but he also warned that many simply don’t need touchscreens on their trusty PCs.

On the other hand, more touchscreens and mouth-watering price points could spell more competition in the cutthroat tablet market, dominated by Apple and Android gear. A number of manufacturers are already working on smaller Windows 8 tablets as well. The success of the iPad mini and even cheaper 7-inch ARMdroids did not go unnoticed, but it will take some effort to make Windows 8 truly competitive in this market, which is already becoming overcrowded.

First of all, Windows 8 is a bloated operating system by tablet standards. This means Windows 8 tablet designs need a lot more storage than their iOS or Android counterparts, which tends to drive the price a bit higher. Windows 8.1, or Windows Blue, could try to tackle this shortcoming. Secondly, they need very efficient x86 chips to be economically feasible, but upcoming x86 SoC designs from Intel and AMD should go a long way towards addressing this issue. Finally, Redmond has to cut Windows 8 prices, plain and simple.

However, Asus CEO Jerry Shen warns that there is no quick fix for Microsoft’s tablet woes. Windows 8 tablets are quite a bit pricier than their Android counterparts and they cost at least $150 more. Shen believes the price gap could narrow to about $50 this year, which should considerably improve Microsoft’s competitiveness.

Acer Chairman J.T. Wang said Microsoft’s willingness to adapt to change is a good sign for the PC industry, reports the Wall Street Journal. He was rather blunt about it, too.

“In the past we consider they (Microsoft) live in heaven,” he said. “But now they go down to earth and they start to learn how people living on earth think.”

Although tablets are generating all the buzz lately, there are some changes on the PC front as well. An increasing number of all-in-ones and more powerful mini-PCs are hitting the market. Ultrabooks sales are still failing to impress, but there is some good news to report on the notebook front as well. Prices of Ivy Bridge notebooks are seeing double-digit cuts, as Intel partners gear up to introduce Haswell-based models over the next few months.

Demand for SSDs to stay strong

Although the PC market has seen better days, shipments of solid state drives are expected to grow more than 600 percent by 2017, according to the latest figures released by IHS. However, even at this rate, two thirds of PCs shipped in 2017 will still have mechanical hard drives, although many of them will probably be hybrids.

Although the PC market has seen better days, shipments of solid state drives are expected to grow more than 600 percent by 2017, according to the latest figures released by IHS. However, even at this rate, two thirds of PCs shipped in 2017 will still have mechanical hard drives, although many of them will probably be hybrids.

PC SSD shipments are expected to hit 227 million units in 2017, up from 31 million last year.

Hard drive shipments will drop to 410 million by 2017, down 14 percent from 475 million in 2012. In just five short years SSDs will claim 36 percent of the market, up from just six percent last year. HDDs will account for the remaining 64 percent, but memory makers stand to cash in from them as well, as hybrid drives hit the market in ever increasing numbers.

The driving force behind the SSD boom will be ultrabooks and other ultrathin devices. IHS analyst Fang Zhang believes ultrabooks and ultrathins, combined with touch screens and convertible form factors, will become very compelling machines, designed to lure consumers away from smartphones and tablets.

Of course, none of this is possible without more consumer interest. Although enthusiasts have been buying SSDs for years, the standard PC box buyer doesn’t care too much about the latest storage technology, which is still too pricey for mainstream adoption. Ultrabooks are slowly changing the public perception of SSDs are geeky devices for gamers and enthusiasts. Consumers are slowly starting to appreciate the added agility and responsiveness of SSD-based systems, and prices are tumbling as well.

On Tuesday Seagate announced its first series of SSD products designed to cover all market segments. The news was closely followed by an announcement from Western Digital and SadDisk, who will collaborate on new hybrid drives. Traditional HDD churners simply have to transition to SSDs and hybrid drives, it is just a matter of time.

“SSDs have dropped in price this year. The industry would probably put this down to supply and demand – but if I’m honest I think it’s all down to competition. Big players are moving in and really taking this industry to the next level – this week WD and Seagate separately announced their SSD push – and it wouldn’t surprise me if these larger players triggered a price war to push smaller players out of the market,” a reseller told us. “In terms of getting consumers more involved isn’t it just a case of making them a more prominent feature of gadgets and cost points? The average consumer just cares about what they can get and for how much.”

More marketing cash from the likes of Seagate and Western Digital will help, but so will tablets and smartphones. Consumer are already enjoying the perks of speedy solid state storage on their iPads and Androids, which means they are far more likely to go for an SSD based PC next time they upgrade. It is basically a case of not downgrading from a horse to a donkey, as Balkanese old wise men would say.

Seagate’s SSD push starts to take shape in Colorado

Hard drive maker Seagate is planning a big push into the solid-drive market and now it seems to be making its first move. The company is hosting a job fair in Longmont later this week and it is looking to hire about 150 people, mostly engineers.

Hard drive maker Seagate is planning a big push into the solid-drive market and now it seems to be making its first move. The company is hosting a job fair in Longmont later this week and it is looking to hire about 150 people, mostly engineers.

Seagate’s 1,250-strong Colorado Design Centre is based in Longmont and it seems it will lead Seagate’s SSD push. Gary Gentry, Seagate VP and general manager of the company’s SSD business, said his client SSD team will be headquartered in Longmont.

“We already have a substantial group and we’re expanding the technology, the product and the business development here in Longmont,” he told Timescall.com.

Seagate’s new 600-series SSDs will be marketed to consumers and OEMs alike, marking a new era in the company’s history. The drives will be available in multiple capacities up to 480GB and they will fit standard hard drive bays, which means we are probably looking at 2.5-inch 7mm units. In addition, Seagate also plans to develop a series of business oriented SSDs at Longmont.

This won’t be the first time Longmont dabbled in flash. The centre was instrumental in the development of Seagate’s hybrid drives (SSHDs) a couple of years ago. It got the job done and Seagate was the first hard drive market to successfully introduce 2.5-inch hybrids. Earlier this year it upgraded and expanded its SSHD offer.

Seagate VP and management lead for the centre Jeff Mason said his team is also developing drives specifically designed to suit the needs of large-scale cloud storage systems. He said the job fair is Seagate’s biggest recruitment in a decade and said the hiring will occur throughout the year.

Although Seagate is betting big on SSDs, it won’t leave the traditional HDD market anytime soon.

“There’s not enough SSD production in the world to replace the amount of storage that magnetic storage devices provide,” said Mason.

Mason pointed out that mobile devices are not a “displacer” for mechanical storage, but rather a stimulant, as mobile devices tend to rely on cloud storage, which is still largely based on mechanical drives.

UK retail sector healthier than in last two years

At its latest quarterly meeting in April, the KPMG/Ipsos Retail Think Tank (RTT) came to the conclusion that the health of the UK retail sector is improving.

At its latest quarterly meeting in April, the KPMG/Ipsos Retail Think Tank (RTT) came to the conclusion that the health of the UK retail sector is improving.

The RTT upped its Retail Health Index by one point to 77 points, the best result in two and a half years.

The RTT cited a marginal lift in demand as the main factor underlining the recovery and things could have been even better had the first quarter of the year not been marred by unusually cold weather. Christmas sales were strong, the food sector performed exceptionally well and the decline in footfall, caused by wintry weather, did not hurt overall demand. Gadgets also did well, as consumers decided to stay indoors and chuck Angry Birds on their shiny new tablets.

However, retailers’ margins weren’t as good. Food margins remained flat and margins on technology products remain low. Costs stayed flat. Although multichannel operations continued to spend more on fuel and energy, this was offset by reductions in estate sizes and creative cost cutting measures.

The outlook for retail health in the second quarter is not so great and it is expected to stay flat, reports FreshBusinessThinking.com. Consumer confidence remains low, inflation is rearing its ugly face again, fuel and energy prices are set to rise, demand still looks very soft.

“Overall the quarter was quite an even one for UK retailers as demand, margins and costs all remained relatively static and it looks like we’re at the bottom of the decline,” said David McCorquodale, Head of Retail, KPMG UK. “The weather did affect demand in terms of footfall being down, but otherwise sales were largely ok.”

Scotch Whisky industry escalator for sales causes slump

Sales of Scotch whisky in the UK have declined 12 percent over the last five years and the Scotch Whisky Association has pinned the blame for the slump on the alcohol duty escalator. In 2012 Brits bought 90 million bottles of whisky, down from 102 million in pre-recession 2007.

Sales of Scotch whisky in the UK have declined 12 percent over the last five years and the Scotch Whisky Association has pinned the blame for the slump on the alcohol duty escalator. In 2012 Brits bought 90 million bottles of whisky, down from 102 million in pre-recession 2007.

The escalator increases the duty on whisky by two percent above inflation every single year and to make matters worse the 2013 Budget also featured an increase in duty of 5.3 percent, reports Tax-News.com.

The Scotch Whisky Association says tax accounts for 80 percent of the total retail price of a bottle of whisky. Furthermore, beer is not covered by the escalator, hence the association believes the exemption unfairly distorts the market, as whisky lovers are paying 48 percent more duty than beer guzzlers. The association is now calling for the duty escalator to be scrapped altogether.

“There is no justification for spirits being taxed more heavily than beer. After more than half a decade, the Government should review the duty escalator rather than maintain the mantra that it should run for the remainder of this Parliament. The escalator will further depress the volume of sales of Scotch whisky in the UK,” said Gavin Hewitt, chief executive of the SWA,

The Scotch Whisky Association pointed out that the Scotch whisky industry supports 35,000 jobs across the UK, including quite a few in economically deprived areas, i.e. Scotland.

Authorize.Net lands in Blighty, Euroland

Payment gateway Authorize.Net is now available for British and European merchants, dealing in GBP, EUR and USD. Authorize.Net is a small business solution from CyberSource, a Visa company. It is a popular payment platform designed to accept and manage card transactions, fight fraud and automate recurring transactions.

Payment gateway Authorize.Net is now available for British and European merchants, dealing in GBP, EUR and USD. Authorize.Net is a small business solution from CyberSource, a Visa company. It is a popular payment platform designed to accept and manage card transactions, fight fraud and automate recurring transactions.

Simon Stokes, managing director EMEA at CyberSource, said the platform is now able to cater to merchants of all sizes throughout the UK, ranging from home-based start-ups to the biggest enterprise merchants. He was quick to point out that Authorize.Net is the most popular payment gateway in the US. Currently more than 380,000 merchants use Authorize.Net stateside.

“We believe UK merchants will benefit greatly from Authorize.Net’s stability, ease of use, and award winning support,” said Stokes.

In addition to bank card processing, Authorize.Net also provides merchants with a virtual terminal and a website payments seal. It also supports recurring billing, a suit of fraud detection filters and secure data storage. CyberSource also likes to point out that Authorize.Net’s customer support has received quality awards for four years running, so timely support shouldn’t be an issue.

Tablet juggernaut rolls on

Worldwide tablet sales continued to surge, growing 142.4 percent in the first quarter of 2013.

Worldwide tablet sales continued to surge, growing 142.4 percent in the first quarter of 2013.

According to IDC’s latest figures, tablet shipments totalled 49.2 million units in Q1, surpassing the first two quarters of 2012 combined. It seems growth is now being fuelled by smaller and cheaper devices.

Since small and cheap tablets are almost exclusively powered by Android, Google’s once fledgling mobile OS is starting to overtake Apple, and we might see a repeat of the smartphone wars. However, Apple is not going anywhere anytime soon. It still managed beat IDC’s latest projections, shipping 19.5 million iPads, 800,000 more than the original forecast and up 65.3 percent compared to a year ago. Samsung also did well, piggybacking the success of its Galaxy series phones with Galaxy branded tablets. The Korean giant shipped 8.8 million tablets, up 282.6 year-on-year. Asus shipped 2.7 million, up a whopping 350 percent in a single year.

Amazon ranked fourth, with 1.8 million units shipped and 157 percent YoY growth. Not exactly a bad result, but then again Amazon really doesn’t have much to show for all its Kindle Fire hype. Good old Microsoft sold just 900,000 Surface tablets, which are still struggling to become relevant. Worse, total Windows tablet sales, including the Surface RT, Surface Pro and all other tablets based on Windows RT and Windows 8 totalled just 1.8 million units.

The numbers clearly show that most growth is coming from Android tablets. Although Apple is still growing at an impressive pace, the market is slowly becoming saturated with inexpensive droids. The combined Android market share stands at 56.5 percent, while apple is down to 40 percent.

This is nothing new, we saw the same trend in the smartphone market a couple of years ago and it worked like a charm. By flooding the market with cheap 7- to 8-inch Android tablets, Google might pull it off in the tablet space as well, although it still has a long way to go.

Overseas online sales to soar to £28bn

According to research from OC&C Strategy Consultants and Google, British retailers could see their overseas online sales soar to £28 billion by the end of the decade.

According to research from OC&C Strategy Consultants and Google, British retailers could see their overseas online sales soar to £28 billion by the end of the decade.

Researchers concluded that growth in online sales will outpace domestic growth and eventually account for 40 percent of total online sales by 2020.

British retailers are already doing quite well abroad. In fact, international consumers spent £7.4 billion on British online retail sites last year, making up about 14 percent of total online sales. This year British retailers are expected to net £10 billion from cross-border sales.

OC&C Strategy Consultants and Google found that growth will come from multiple regions, with western Europea leading the way. Sales in western Europe are expected to hit £9.8 billion by 2020, up from £1.5 billion last year. Central and Eastern Europe will see plenty of growth as well, with sales reaching £6.9 billion by the end of the decade, up from £400 million last year.

Sales in Asia are expected to hit £4.5 billion by 2020, while North America will lose its position as the top market for British online retailers. The North American market is currently estimated at £800 million and it is set to expand to £2.7 billion in 2020. The American market is simply more mature than the rest of the world, which translates into slower growth.

“We have seen a significant increase in the volume of searches for British retailers and brands coming from overseas,” Peter Fitzgerald, director at Google, said. “The majority of non-UK searches are currently coming from Europe, followed by North America and Asia, driven by the increased popularity of British brands abroad. Retailers can use search data to identify pockets of demand and move quickly to meet the needs of customers.”

Anita Balchandani, partner at OC&C, said e-commerce has already transformed the retail game, which was once anchored in local markets.

“There are a number of reasons why growth in e-commerce is changing the rules of internationalisation. Firstly, geographical proximity no longer determines which market is best suited for expansion – the internet allows customers seek out the best offers from around the world,” she said. “Secondly, the nature of risk has changed. International expansion is much less capital intensive and this is creating growth opportunities which have a more controlled exposure to risk. Thirdly, the speed with which companies expand has also accelerated – over 40 of Britain’s top-100 etailers serve customers in more than 40 countries.”

SMBs throw cash about

Small and medium businesses are hiring dedicated e-commerce specialists in ever growing numbers.

Small and medium businesses are hiring dedicated e-commerce specialists in ever growing numbers.

According to a report from Freelancer.co.uk, SMBs are realizing that they need to offer safe and convenient online services, on par with the big boys. The number of businesses hiring e-commerce experts has gone up 19 percent in the first quarter of 2013.

Freelancer spokesman Matt Barrie stressed that the high street is already facing major problems due to the e-commerce boom. He warned that plenty of major retailers have already seen their businesses disintegrate because they lacked a good online presence. Smaller outfits seem to have learned their lesson, so they are investing in e-commerce in the hope of not becoming the next Jessops or HMV.

Barrie believes that even the biggest high street players could see their businesses go down the drain if they fail to embrace online shopping. It could be good news for smaller companies, as e-commerce could level the playing field and allow them to compete with bigger outfits, without much overhead. The web allows small companies to offer their goods and services to a much larger audience, so it could be used to their advantage.

Another aspect of the e-commerce revolution involves niche markets. Although they are diluted across the country, geography simply isn’t a limiting factor in e-commerce, which means that even tiny companies can cater to the entire niche market.

“Retail outlets are proving incapable of adjusting to a consumer base no longer geographically captive. E-commerce is dominating the consumer retail landscape,” said Barrie. “It’s no surprise that big name retailers that haven’t kept up with the online shopping revolution are increasingly going bankrupt. These high street dinosaurs are unwilling to compete, and so will soon be consigned to retail history.”

Big retail chains have all but monopolized the high street in recent years, but it seems e-commerce has the potential to reverse the trend and put independent retailers back on the map.

Cheap tablet onslaught to intensify

Tablet makers are set to roll out the next generation of cheaper tablets over the coming weeks and it is now clear that competition in the cutthroat market will intensify in the second half of the year.

Tablet makers are set to roll out the next generation of cheaper tablets over the coming weeks and it is now clear that competition in the cutthroat market will intensify in the second half of the year.