While you would expect with all the market turmoil of Brexit, hung governments, and Donald Trump, business leaders would be in a bit of a panic. But KPMG’s global survey found otherwise.

While you would expect with all the market turmoil of Brexit, hung governments, and Donald Trump, business leaders would be in a bit of a panic. But KPMG’s global survey found otherwise.

KPMG global survey finds 65 percent of CEOs remain confident amid heightened uncertainty in the global economy

KPMG International today released its 2017 Global CEO Outlook, based on in-depth interviews with nearly 1,300 CEOs of some of the world’s largest companies.

This year’s CEO Outlook reveals that 65 percent of CEOs see disruptive forces as an opportunity, not a threat, for their business. CEOs are still broadly confident about the prospects for the global economy, but their optimism is more modest than it was last year, with 65 percent expressing confidence compared with 80 percent last year.

KPMG Global Chairman John Veihmeyer said that disruption has become a fact of life for CEOs and their businesses as they respond to heightened uncertainty.

“But importantly, most see disruption as an opportunity to transform their business model, develop new products and services, and reshape their business so it is more successful than ever before. In the face of new challenges and uncertainties, CEOs are feeling urgency to ‘disrupt and grow’.”

KPMG’s 2017 Global CEO Outlook report provides insights of global CEOs’ expectations for business growth, the challenges they face and their strategies to chart organizational success over the next three years. Other key findings include:

More than six in 10 CEOs (65 percent) see disruption as an opportunity, not a threat, for their business. Three in four (74 percent) say their business is aiming to be the disruptor in its sector.

Within their own businesses, more than eight in 10 CEOs (83 percent) describe themselves as confident in their company’s growth prospects for the next three years, with around half (47 percent) saying they are very confident.

Almost seven in 10 (68 percent) say they are evolving their skills and personal qualities to better lead their business.

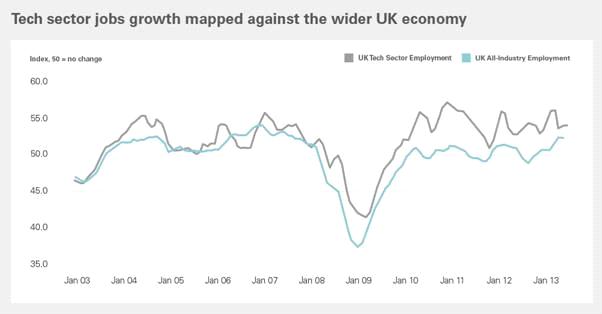

As they adopt cognitive technologies, businesses are expecting short-term headcount growth. Across 10 key roles, an average of 58 percent of CEOs are expecting a slight or significant growth in numbers.

Close to half (45 percent) say their customer insight is hindered by a lack of quality data. More than half (56 percent) are concerned about the data they are basing decisions on.

Veihmeyer said that CEOs understand that speed to market and innovation are strategic priorities for growth in uncertain conditions

“At the same time, they are being pragmatic about managing uncertainty – this includes strengthening their business in established markets so they can protect their bottom line while preparing to seize new opportunities.”

British group SSC toppled IBM from the leading three in TOP 2022, a ranking of the 170 largest French Digital Services (ESN) and Engineering and Technology Consulting (ICT) companies by revenue.

British group SSC toppled IBM from the leading three in TOP 2022, a ranking of the 170 largest French Digital Services (ESN) and Engineering and Technology Consulting (ICT) companies by revenue.