Listening to Canalys CEO Steve Brazier bang on in Venice you can’t help but think that the direct model is going to die a death.

Listening to Canalys CEO Steve Brazier bang on in Venice you can’t help but think that the direct model is going to die a death.

Talking to the annual conference over cheese on a stick and drinkies Brazier said that channel partners are doing well and the European economy is looking better that it has done for the last ten years.

He said that there were more opportunities for the channel now than there have ever been.

This year, over the first half, distributors grew 4 to 5 percent and channel partners improved by seven percent on average.

Brazier, at the Channels Forum event, spoke of the way vertical markets, from retail, transport, health and public sector, were all “embracing” digital technology and using the channel to roll out those services.

The move towards edge computing is also driving a lot of growth and Brazier expected a growth in ‘micro clouds’ as resellers provided services closer to user data and applications.

There was also a mention of security, with that segment enjoying the strongest growth as a result of the increasing threats and factors like GDPR driving spending across Europe.

However the wholesale move towards becoming a predominately software and services business is probably going to be as grim as the life expectancy of a wedding guest in the Game of Thrones.

“This has been the year where the vendors have been preaching digital transformation to you. They are not only trying to talk to you about selling more stuff, they are trying to battle for your thought leadership in where you will take your thoughts forwards,” Brazier said.

“I’m sure you have been told you need to change the way you engage with customers and invest more in digital marketing and retrain your sales force,” he added.

Brazier warned that listening to the vendors, which had their own agendas, could undermine the future strategy.

“Should a partner that’s reselling infrastructure, PCs and software should they change? Probably yes,” he said.

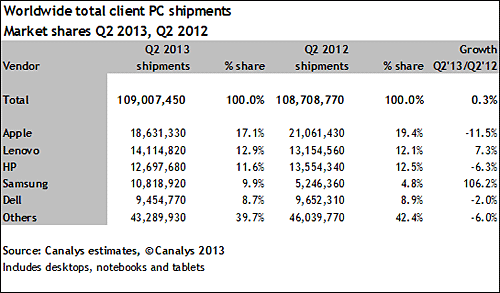

Canalys is predicting that hardware will still contribute over 50 percent of revenues for 90 percent of partners in 2020.

“Whoever told you selling hardware was dead is completely wrong. The PC is suddenly the most profitable part of your business again”, said Brazier.