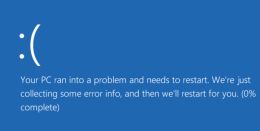

Microsoft announced its fiscal Q4 results last night and unsurprisingly the results missed expectations by a wide margin. The PC market remains slow, hence Redmond’s numbers can’t be good. The company reported revenue of $19.9 billion and earnings of $4.97 billion.

Microsoft announced its fiscal Q4 results last night and unsurprisingly the results missed expectations by a wide margin. The PC market remains slow, hence Redmond’s numbers can’t be good. The company reported revenue of $19.9 billion and earnings of $4.97 billion.

However, Microsoft’s attempt to tap the tablet market seems to have failed quite spectacularly. Redmond announced an embarrassing $900 million inventory write-down for Surface RT tablets. So, instead of helping the company out, the Surface burned a massive hole in its pocket.

Last week Microsoft slashed the Surface RT price by $150 in an apparent effort to clear inventory. The company is already working on the next generation of Surface RT products and it apparently includes two different form factors. The problem is that nobody else appears to be working on RT devices – in fact vendors seem to be running away from it like a particularly nasty flu bug.

The only companies who still seem to be supporting Windows RT are Qualcomm and Nvidia, which comes as no surprise since they are supposed to build the chips for next generation Surface devices. In a recent interview with Computerworld, Nvidia vice president of computing products Rene Haas said the chipmaker is still committed to Surface RT and Windows RT. He said he is excited by the “new price point” which might inspire new sales.

However, analysts are having none of it.

J. Gold Associates analyst Jack Gold said that Nvidia is simply marketing its product. “They don’t want to spook the market and say RT sucks and won’t sell,” he said. Analyst and ex-AMD and Compaq employee Pat Moorhead thinks Microsoft won’t ditch the platform anytime soon – even if it means that it will be the only OEM using it.

However, even Microsoft can’t afford such write-downs every couple of quarters and something has to change soon, or it will have another Zune on its hands.