Intel is starting to talk up its 2-in-1s, but for the time being tablets seem to be beating laptops by a ratio of 2 to 1.

Intel is starting to talk up its 2-in-1s, but for the time being tablets seem to be beating laptops by a ratio of 2 to 1.

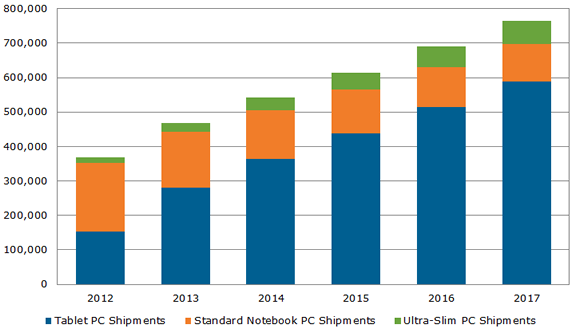

According to NPD DisplaySearch, shipments of tablet PCs will hit 364 million units next year, more than double the projected 177 million for laptops of all shapes and sizes, including Intel’s favourite vapourware of the day, 2-in-1 hybrids.

What’s more, tablet PC sales are expected to hit 589 million by 2017, while sales of laptops and ultraslims will hit 176 million units. Laptops aren’t going anywhere, they just won’t see much growth and they will be complemented by tablets, not replaced by them.

“The PC market is clearly shifting away from notebooks and toward tablets,” said Richard Shim, senior analyst with NPD DisplaySearch. “Supply chain indications reveal that previously planned production of notebook PCs is being pulled back due to declining adoption and that brands are gradually increasing the number of tablet PC models in their product mixes. Panel and finished goods suppliers are also increasing production of displays and other components for tablets in order to keep up with the market changes.”

Most growth in the tablet space is currently coming from emerging markets, where it is having an effect on PC sales. In markets with low PC penetration, most first-time buyers choose laptops, but an increasing number is turning to even cheaper tablets, leading to direct cannibalization. In addition, the market is shifting to cheaper and smaller tablets, which are a better fit for emerging markets than big, high-end tablets.

“Smaller tablets are important, because they will encourage adoption in emerging regions,” Shim said. “Smaller screen sizes translate to lower priced tablet-PC options, since display panels tend to comprise just over a third of the total cost of a tablet, which makes them attractive in price-sensitive markets.”

The choice of tablet form factors is increasing and smaller tablets, with screens up to 8 inches, are expected to account for 59 percent of sales this year. In 2015 they will grab 63 percent of the market and there is a shift from 7-inch panels to 7.5- and 8-inch units. This is encouraging news for laptop makers, as it indicates that consumers are buying cheap and small tablets as companion devices, rather than replacements for proper mobile PCs.