Beancounters at TMR, the global GNSS said the chip market is slated to expand at 7.7 percent each year during 2017 and 2025 to reach a value of US$34.71 billion by 2025 from US$ 17.90 billion in 2016.

Beancounters at TMR, the global GNSS said the chip market is slated to expand at 7.7 percent each year during 2017 and 2025 to reach a value of US$34.71 billion by 2025 from US$ 17.90 billion in 2016.

In terms of volume, the report forecasts the market to expand at a CAGR of 8.7 percent to become worth 9.16 billion units by 2025 from 4.31 billion units in 2016.

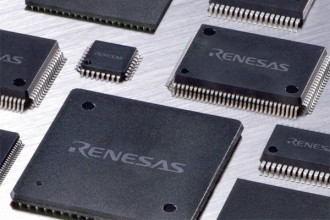

Some of the big names operating in the global navigational satellite system (GNSS) chip market are Qualcomm, ST Microelectronics, Mediatek ., U-Blox, Intel , Furuno Electric, Broadcom and Quectel Wireless. Currently the market is fragmented with no player having a solid stronghold.

The global GNSS chip market can be segmented depending upon the type of devices into in-vehicle networking systems, smart phones, and personal navigational devices, among others such as smart wearable devices, including smart watches, smart glasses, smart rings, etc. In terms of growth rate, the in-vehicle networking systems is expected to outshine all other segments with a CAGR of 10.5 percent, vis-à-vis value, in the years to come, because of the rising connectivity in vehicles for bettering both driving experience and safety.

Based on geography, the key segments of the global GNSS chip market are North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa. Of them, North America, at present, holds a dominant share both in terms of value and volume and in the upcoming years too is predicted to maintain its leading position. This is because most of the prominent manufacturers of GNSS chips are based out of North America. The market in the region is slated to be worth $10.22 billion by 2025.