Avaya has listed on the New York Stock Exchange again ending a terrible 12 months in Chapter 11 and gearing up to offload its networking business to help bring about financial stability.

Avaya has listed on the New York Stock Exchange again ending a terrible 12 months in Chapter 11 and gearing up to offload its networking business to help bring about financial stability.

CEO Jim Chirico said that it was an honour to mark the first day of trading on the NYSE for the new Avaya, which is more focused than ever on leading the industry’s digital transformation.

“Building on our history of innovation and expertise in deploying globally scalable solutions, Avaya sits today at the strategic nexus of connectivity for the enterprise.”

Avaya claims to have more than 130,000 customers worldwide, including 90 percent of the Fortune 500, however that went tits up last year when it filed for Chapter 11, owing millions to its channel partners. At the time it promised to come back “stronger than ever”.

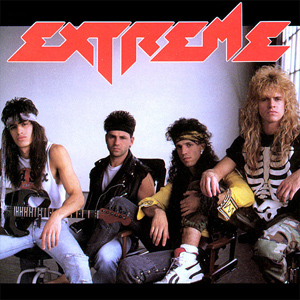

The networking division of the firm has since been sold off to Extreme Networks, and in August last year, Avaya secured a deal to restructure its debt with its largest creditor, which included wiping $3 billion off the amount it owed.