NFC has been around in select high-end phones for years, and Google has included NFC support in every Nexus handset dating back to the Nexus S, which launched in late 2010. However, Apple and a few other names were not as keen to embrace it.

NFC has been around in select high-end phones for years, and Google has included NFC support in every Nexus handset dating back to the Nexus S, which launched in late 2010. However, Apple and a few other names were not as keen to embrace it.

Ad market to grow £3 billion, hit £17 billion by 2017

The UK advertising market is getting a shot in the arm from online operations and it is expected to grow by £3 billion by 2017, reaching £17 billion. According to a new report from PricewaterhouseCoopers (PwC) the UK entertainment and media market will grow at a compound annual growth rate (CAGR) of four percent between 2013 and 2017, reaching £65.5 billion, up from £54 in 2012.

The UK advertising market is getting a shot in the arm from online operations and it is expected to grow by £3 billion by 2017, reaching £17 billion. According to a new report from PricewaterhouseCoopers (PwC) the UK entertainment and media market will grow at a compound annual growth rate (CAGR) of four percent between 2013 and 2017, reaching £65.5 billion, up from £54 in 2012.

Dell and Oracle cosy up

The partnership between Dell and Oracle appears to be getting closer.

The partnership between Dell and Oracle appears to be getting closer.

For a while now Dell has been packaging Oracle software and services with hardware, while Oracle optimised services for Dell’s products.

According to Sourcing Focus, the relationship is hotting up.

The two companies are starting to share customer support and engineering support services. Oracle is now listing Dell as a preferred x86 partner for deploying its software. At the same time, Dell highlighted Oracle as a preferred enterprise software provider for its hardware.

Oracle Co-President Mark Hurd described the shared relationship between the two IT giants as: “We test it together, we patch it together, we support it together.”

What is odd about the relationship is that the pair sometimes compete in different markets. Ironically, by working together, they hope to get a general competition advantage.

Dell has to come up with some new ideas as it tries to get back its market share after a downturn in its traditional PC markets.

It is not clear what Oracle’s advantage is, particularly as it has its own hardware business which is also not doing so well.

Hurd admitted that this more of a win for Dell and that this expanded alliance will enable Dell to “gain significant market share by delivering to its customers an integrated, optimized solution designed to deploy business critical applications”.

SAP buys Hybris

SAP is acquiring e-commerce technology company Hybris, which SAP hopes will help it to further develop on premise or cloud deployment for the platform.

SAP is acquiring e-commerce technology company Hybris, which SAP hopes will help it to further develop on premise or cloud deployment for the platform.

Hybris, SAP boasts, is currently the fastest growing e-commerce software company and covers web, mobile, call centre and in store channels. The idea is to help Hybris customers sell whatever they’re offering against each of these channels, using data to provide insight into every layer of the buying process.

The Zug, Switzerland based company’s top investor is Palo Alto investment firm HGGC.

SAP believes combining its own SAP HANA and SAP Jam platforms with Hybris’ software will help it expand the reach of the commerce platform. “The acquisition will further SAP’s ability to help companies fully engage customers to improve loyalty and create stronger, more valuable relationships,” SAP said in a statement.

Co-CEOs at SAP AG, Bill McDermott and Jim Hagemann Snabe, said in a joint statement: “Hybris puts SAP on the leading edge of the consumer economy. With Hybris, SAP has made a decisive move to raise the stakes in customer relationship management”.

Essentially, the acquisition will see SAP trying to carve up a larger slice of e-commerce, taking on players such as Salesforce and others.

The acquisition is expected to complete in the third quarter of this year, subject to all the usual approvals and closing conditions. Hybris will be owned by SAP but operate as an independent business, keeping its management team.

Toyota recalls 5,000 Prius hybrids in UK

Toyota has been forced to recall 4,947 third-generation Prius models in the UK. A total of 242,000 cars are being recalled globally due to a potential component fault in the brake pedal.

Toyota has been forced to recall 4,947 third-generation Prius models in the UK. A total of 242,000 cars are being recalled globally due to a potential component fault in the brake pedal.

Ovum eggs on BYOD market

Research outfit Ovum is telling the world+dog that the bring your own device trend is here to stay.

Research outfit Ovum is telling the world+dog that the bring your own device trend is here to stay.

One of the findings of Ovum’s 2013 multi-market bring-your-own-anything employee study indicates that the trend is not only just “here to stay” it is also going to increase.

Corporate BYOD activity by full-time employees has remained steady at almost 60 percent over the past two years.

Already global industry analysts warn business leaders to respond and adapt now to this change in employee behaviour, rather than being steamrollered by it, the report said.

Ovum said that nearly 70 percent of employees who own a smartphone or tablet choose to use it to access corporate data. The personal tablet market continues to grow, and with personal tablet ownership by FTEs rising from 28.4 per cent to 44.5 per cemt over the last 12 months, more businesses will see these devices on their networks.

The report said that this will happen whether the CIO wants it to or not. More than 67.8 percent of smartphone-owning employees bring their own smartphone to work, and 15.4 percent of these do so without the IT department’s knowledge and 20.9 percent do so in spite of an anti-BYOD policy.

Richard Absalom, consumer impact technology analyst at Ovum said that it was impossible to stand in the path of consumerised mobility.

“We believe businesses are better served by exploiting this behaviour to increase employee engagement and productivity, and promote the benefits of enterprise mobility,” he said.

Ovum’s research also depicts the rise of a “bring-your-own-application” trend.

While email and calendar remains the most commonly used application on both corporately provisioned and personally owned devices, the usage of new-generation cloud productivity applications, such as enterprise social networking, file sync and share and IM/VoIP, is growing fast.

What worries Ovum is that these types of apps are increasingly being sourced by employees themselves and not through managed corporate channels. A quarter of employees discovered their own enterprise social networking apps, while 22.1 percent of employees discovered their own file sync and 30.7 percent found their share apps and IM/VoIP apps.

If employees are sourcing their own applications to do their job, then IT is not delivering the right tools or a good enough service for employees, Absalom said.

The dangers of big corporate partners

Salesforce is writing a cheque for $2.5 billion to buy ExactTarget in a move which should be putting the frighteners on its marketing software partners such as Marketo.

Salesforce is writing a cheque for $2.5 billion to buy ExactTarget in a move which should be putting the frighteners on its marketing software partners such as Marketo.

Buying ExactTarget will push Salesforce deeply into marketing software which is a region it has so far looked to its partners to provide.

Salesforce owned several marketing-related technology outfits but these were mostly to put adverts on social media sites. But ExactTarget looks at multi-channel marketing automation, an area where Salesforce.com has generally relied on Marketo.

In the announcement Salesforce highlighted a Gartner report which predicted that chief marketing officers will spend more money on IT than CIOs by 2017.

Salesforce.com and ExactTarget’s products, when combined, will “create a world-class marketing platform across email, social, mobile and the web,” Salesforce.com said in a statement.

Salesforce is coy about the effect that such a move will have on its business partnerships, in fact it is hardly mentioning it at all.

However, the move might cause some alarm. When the economy is at a low ebb, bigger aggressive companies can pick up some of their partners quite cheaply.

Marketo has suddenly found that one of its closest partners has now become a rival. It is fairly likely that it will not be the first channel partner to find itself in such a situation.

It might be worth partners, who are dependent on multi-national, cash rich outfits, to pop around with their sales figures and customer lists and suggest that the bigger companies buy them out. Certainly it might give them some form of job security and direct the bigger company’s attention away from rivals before it is too late.

Toshiba sees signs of life in PC market

Although the PC market is in turmoil, Toshiba believes all is not lost and there is still room for growth. Speaking at the sidelines of a notebook launch event on Tuesday, Toshiba UK product manager Paul Hicks expressed a bit of optimism, which is becoming a rare commodity in the PC industry.

Although the PC market is in turmoil, Toshiba believes all is not lost and there is still room for growth. Speaking at the sidelines of a notebook launch event on Tuesday, Toshiba UK product manager Paul Hicks expressed a bit of optimism, which is becoming a rare commodity in the PC industry.

Tesco sales slide in first quarter

Britain’s biggest retailer has reported a one percent slide in UK sales for its fiscal first quarter, ending 25 May, but things are even worse in Europe with a 5.5 percent slump.

Britain’s biggest retailer has reported a one percent slide in UK sales for its fiscal first quarter, ending 25 May, but things are even worse in Europe with a 5.5 percent slump.

Tesco’s results are worse than expected, despite the fact that the chain spent £1 billion to boost UK sales.

Top logistics hubs in Europe named

According to a report from Colliers International, the best logistics hubs on the continent are Antwerp, Rotterdam and Dusseldorf, which is hardly surprising, but the report also took a look at emerging centres, behind what once used to be the Iron Curtain.

According to a report from Colliers International, the best logistics hubs on the continent are Antwerp, Rotterdam and Dusseldorf, which is hardly surprising, but the report also took a look at emerging centres, behind what once used to be the Iron Curtain.

Microsoft to bundle Office with Win 8.1

Software giant Microsoft said at Computex today that when Windows 8.1 launches towards the end of this year, it will bundle Office with the operating system.

Software giant Microsoft said at Computex today that when Windows 8.1 launches towards the end of this year, it will bundle Office with the operating system.

It also said that Windows 8.1 will support smaller form factor tablets and it will vary its licensing model to reflect that change.

Nick Parker, OEM VP at Microsoft, said: “We’re increasing our investment by providing Office in the box. That gives OEMs and their channel partners a premium sale, rather than an aftersale.”

But he seemed to imply that other than these changes, there will be no other licence changes.

Despite analysts reporting that there is a widespread fall in PC sales, Parker refused to be drawn on how that had affected sales of Windows 8. Nor did he accept the view of some analysts that disappointment about the original rev of Windows 8 had itself affected sales.

“We’re an industry going through transformation,” Parker said. “If you look at the categories where we have growth. it is up to us in the PC industry to be more agile”.

Microsoft will also bundle Office with RT, when the time comes.

Don’t tell AMD: Richland on sale in EU

AMD is planning to introduce its next generation desktop Richland APUs tomorrow, to spice up what was a rather underwhelming showing at Computex. It has come up with a clever teaser video, in which it pits the new A10-6800K against Intel’s Core i5-3470, with and without dedicated Nvidia GT 630 graphics (spoiler alert: AMD’s new baby comes out on top).

AMD is planning to introduce its next generation desktop Richland APUs tomorrow, to spice up what was a rather underwhelming showing at Computex. It has come up with a clever teaser video, in which it pits the new A10-6800K against Intel’s Core i5-3470, with and without dedicated Nvidia GT 630 graphics (spoiler alert: AMD’s new baby comes out on top).

However, although AMD has yet to introduce the new chips, most European retailers don’t seem to have gotten the memo. They are already selling them and they’re available from Scotland to Poland in dozens of shops. The prices are pretty good, too.

The range starts with the A4-4000, which is available for just £29. Of course, it’s not exactly a powerhouse, but it does have 1MB of cache, two cores clocked at 3.2GHz and Radeon HD 7480D integrated graphics with 128 shaders. The rest of the range is a bit more serious. The A6-6400K Black Edition is a dual-core clocked at 3.9GHz, with an unlocked multiplier. It’s going for £55, which isn’t bad at all.

Moving on to quad-cores, the A8-6500 is a 65W part clocked at 3.5GHz and priced at £92. It has 2x2MB of cache along with HD 8570D graphics, with 320 shaders clocked at 800MHz. The A8-6600K is a 3.8GHz quad core with the same HD 8570D graphics, clocked at 844MHz. It’s priced at £85.

The top of the range A10 parts aren’t too pricey. The A10-6700, a 3.7GHz quad core with 2x2MB of cache and a 65W TDP costs £115. It features HD 8670D graphics with 384 shaders, clocked at up to 844MHz. The A10-6800K Black Edition is a bit beefier. It’s a 100W part clocked at 4.1GHz, but it retains the same GPU, although it ships with an unlocked multiplier. Oddly enough, it costs a bit less than the 6700, and it is available, with prices starting as low as £109.

You can check out the listings here.

Gartner predicts mobile payment will rocket

Worldwide mobile payment transaction values will rocket this year according to Gartner, which predicts these transactions will hit $235.4 billion in 2013 – a 44 percent boost from $163.1 billion in 2012.

Worldwide mobile payment transaction values will rocket this year according to Gartner, which predicts these transactions will hit $235.4 billion in 2013 – a 44 percent boost from $163.1 billion in 2012.

The number of mobile payment users worldwide will reach 245.2 million in 2013, up from 200.8 million in 2012, according to the research.

Sandy Shen, research director, Gartner, said the company expected global mobile transaction volume and value to average 35 percent annual growth between 2012 and 2017. He added the company was forecasting a market worth $721 billion with more than 450 million users by 2017.

Despite this, the company had lowered the forecast of total transaction value “due to lower-than-expected growth in 2012, especially in North America and Africa”.

Near Field Communications’ (NFC’s) transaction value has also been slashed with a reduction of 40 percent throughout the forecast period. Gartner said this is thanks to disappointing adoption of NFC technology in all markets in 2012, and the fact that some high-profile services, such as Google Wallet and Isis, struggled to gain traction.

Gartner predicts NFC will account for just two percent of total transaction value in 2013 and five percent of the total transaction value in 2017. However, growth is expected to increase from 2016 when the penetration of NFC mobile phones and contactless readers increases.

Money transfers and merchandise purchases will account for about 71 percent and 21 percent of total transaction value in 2013, respectively, making them by far the largest contributors. Worldwide, people are not purchasing as much because the buying experience on mobile devices has yet to be fully optimised, though the economic situation must count for something too.

People are spending less using mobile devices than through online e-commerce services and at retail outlets. Merchandise purchases account for about 23 percent of the total value forecast for 2017, Gartner said.

Bill payment value should grow 44 percent in 2013 and maintain consistent growth through the forecast period. Gartner said this is thanks to higher value per transaction figures, as more consumers in developed markets performed bill payments using mobile banking services – along with consumers in emerging markets who are transacting at higher values than originally forecast.

Western Europe’s transaction value is expected to reach $29 billion in 2013, up from $19 billion in 2012.

Avnet exits MEA market

Avnet has confirmed that it’s pulling its operations in the Middle East and Africa (MEA) region.

Avnet has confirmed that it’s pulling its operations in the Middle East and Africa (MEA) region.

The distie has said that it made the decision after a review of the business concluded that it was “unlikely to make the necessary returns needed to meet [its] strategic goals in the short- or mid-term.”

In a statement the company said the that the “difficult” decision would not impact the computer components and integrated solutions business which continue to support key partners in the region.

However it pointed out that it had to make the moves and take the action to realign resources from underperforming businesses to areas that can deliver strong performance for Avnet, its suppliers and partners.

Avnet also claimed its immediate priorities were to ensure that it provided the necessary support to its employees throughout this process and to fully assist its supplier and business partners as we manage our exit from this market.

“Our decision to exit this region will have no impact on the independently operating Avnet Electronics Marketing business in the region, specifically South Africa and Israel,” the statement said.

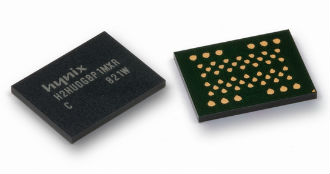

Memory prices rise

Prices of NAND and DRAM memory are going up as a result of an apparent shortage. Supplies of NAND modules seem to be particularly hard hit because of strong demand for SSDs, tablets and smartphones.

Prices of NAND and DRAM memory are going up as a result of an apparent shortage. Supplies of NAND modules seem to be particularly hard hit because of strong demand for SSDs, tablets and smartphones.