The first quarter of 2013 was the worst for PC sales since 1994, IDC said.

The first quarter of 2013 was the worst for PC sales since 1994, IDC said.

In its Worldwide Quarterly PC Tracker, the company pointed the finger at Windows 8 disrupting the market amongst tough trading conditions, reporting that shipments totalled 76.3 million units in the first quarter of 2013, a decline of 13.9 percent compared to the same quarter in 2012.

The dismal figure was also even worse than the forecast decline of percent 7.7 percent IDC had predicted, with the company adding the extent of the year-on-year contraction marked the worst quarter since it began tracking the PC market quarterly in 1994.

The results also marked the fourth consecutive quarter of year-on-year shipment declines.

Despite some mild improvement in the economic environment and some new PC models offering Windows 8, PC shipments were down significantly across all regions compared to a year ago.

IDC said fading Mini Notebook shipments had also taken a big chunk out of the low-end market while tablets and smartphones continued to divert consumer spending.

And it seems innovation has also hindered rather than helped the PC industry with IDC pointing out that efforts to offer touch capabilities and ultraslim systems have been hampered by traditional barriers of price and component supply, as well as a weak reception for Windows 8.

It added that the PC industry was struggling to identify innovations that made PCs stand out from other products and encourage people to buy.

The Windows 8 launch was blamed partly for the huge decline with Bob O’Donnell, IDC Programme Vice President, Clients and Displays claiming it not only failed to provide a positive boost to the PC market, but had also slowed down the market .

He said the “radical changes” to the UI including the absence of the Start button, plus the costs associated with touch had made PCs a less attractive alternative to dedicated tablets and other competitive devices.

“Microsoft will have to make some very tough decisions moving forward if it wants to help reinvigorate the PC market,” he warned.

And other vendors have also been blamed with the restructuring and reorganisation efforts of HP and Dell claimed to have hampered the market.

In fact it seems only Lenovo has come out smelling of roses, with IDC claiming it continued to “execute on a solid “attack” strategy”,

It said to keep up with the rat race, vendors had to revisit their organisational structures and “go to market strategies” – whatever that means, as well as their supply chain, distribution, and product portfolios in the face of shrinking demand and looming consolidation.

And regionally there wasn’t better news. Across the pond, the United States contracting 12.7 percent year on year, with a drop of -18.3 percent for the first quarter of 2013 compared to the fourth quarter of 2012 and quarterly shipments reached their lowest level since the first quarter of 2006.

In Blighty and the EMEA region, the news remained bleak with IDC claiming that the area

posted a stronger double digit decline than anticipated in the first quarter of 2013.

Results fell short of expectations in the consumer segment as softness in demand persisted amid a continued shift to tablets and budget pressures. Meanwhile, the market response to Windows 8 and touch-enabled devices remains slow, leading to cautious “sell-in” from most vendors.

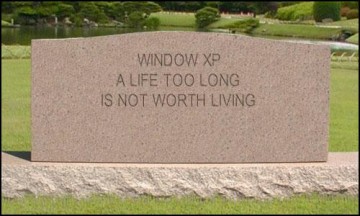

Japan fared a little bit better, with PC shipments in line with expectations in the first quarter. IDC said this was down to some economic improvement, which was helping to support commercial replacement demand ahead of the scheduled end of support for Windows XP next year.

However, consumer shipments remained very weak.

And Japan’s friends in the Asia/Pacific region didn’t have much to celebrate about with PC shipments declining sharply, dropping a record 12.7 percent.

IDC also pointed out that this was the first time the region had experienced a double digit decline. Although much of the earlier Windows 7 stock had cleared, a lukewarm reception toward Windows 8 hampered new shipments.

China’s inactivity contributed heavily to the decline, as public sector spending continued to be constrained.

HP remained the top vendor, but posted a substantial double digit decline in shipments after an aggressive fourth quarter kept growth flat during the holidays. HP’s worldwide shipments fell more than 23 percent year on year in the first quarter of 2013, with significant declines across all regions, as internal restructuring continued to affect commercial sales. Although HP maintained its leadership position in the United States, the company saw US shipments fall -22.9 percent from a year ago.

Lenovo remained second in global shipments and nearly closed the gap with HP, while Dell saw shipment decline by 10 percent globally and 14 percent in the United States. The vendor continued to face tough competition and struggled with customer uncertainty about the direction of its restructuring.

Apple fared better than the overall US market, but still saw shipments decline as its own PCs also face competition from iPads.

In what can only be described as a last ditch effort to keep Surface tablets from flopping, Microsoft has launched a new channel programme in the United States. The programme should push sales of Surface tablets to businesses and other organisations.

In what can only be described as a last ditch effort to keep Surface tablets from flopping, Microsoft has launched a new channel programme in the United States. The programme should push sales of Surface tablets to businesses and other organisations.