Foxconn may be about to diversify and try its luck in the smartphone and tablet business, under its own brand. The company has been building iPhones, iPads and a range of other products for years and now it’s selling smart TVs, with a bit of help from 7-Eleven Taiwan.

Foxconn may be about to diversify and try its luck in the smartphone and tablet business, under its own brand. The company has been building iPhones, iPads and a range of other products for years and now it’s selling smart TVs, with a bit of help from 7-Eleven Taiwan.

Foxconn launched its TV assembly business in 2008 and it has expanded it in recent years with the acquisition of manufacturing facilities from Sony. It also bought a 50 percent stake in Sharp’s panel making plant in Japan, reports the Wall Street Journal.

Shoppers in Taiwan can already buy a range of Foxconn tellies and with gaudy ads like this one for a 40-inch smart TV, who could resist? However, the big news is that Foxconn may be about to launch smartphones and tablets of its own, or through some sort of deal with 7-Eleven.

This is not good news for Chinese white-box outfits. They have been performing quite well recently and demand for white-box smartphones and tablets is quite strong, often outstripping growth reported by big brands. If Foxconn enters the fray, the white-box crowd will face a lot more competition.

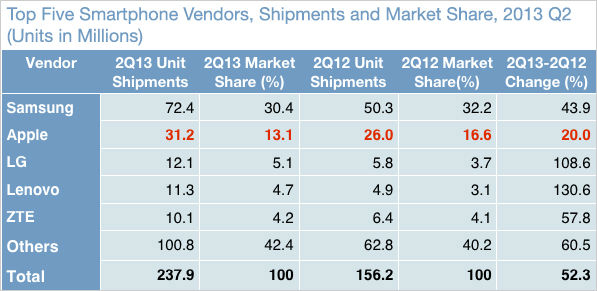

Foxconn has a lot of experience and capacity second to none, but it doesn’t actually make any crucial components used in smartphone or tablets. This is true of most smartphone outfits except Samsung.

There is no shortage of high resolution panels, cheap application processors, cameras or batteries. Depending on volume Foxconn could get much better prices than small white-box companies. However, it is still unclear whether Foxconn’s push will be limited to the 7 Eleven deal, or whether it will spread to other markets.

The company certainly has the muscle to pull off a global rollout, but this might not be necessary, at least not for now. Foxconn could instead choose to target a handful of emerging markets like China, markets that are not very saturated and that tend to scoop up white-box phones. The exact same markets Lenovo is gunning for. Such an approach could give Foxconn a foothold in the mobile industry through a back door, as it wouldn’t have to go head to head with Samsung or Apple.