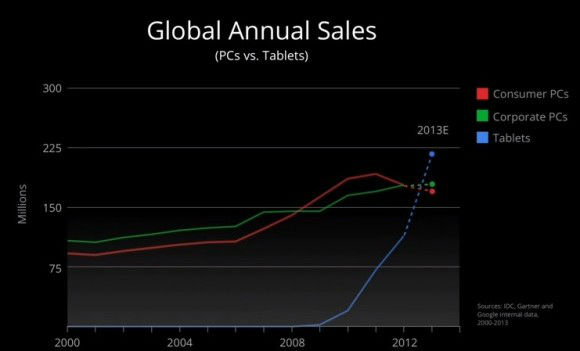

It appears that worldwide shipments of media tablets will outpace PCs by the end of the year. Speaking at Google’s breakfast event on Thursday, head of Android and Chrome Sundar Pichai shed light on some impressive tablet shipment figures. His claims are backed up by IDC’s latest reports.

It appears that worldwide shipments of media tablets will outpace PCs by the end of the year. Speaking at Google’s breakfast event on Thursday, head of Android and Chrome Sundar Pichai shed light on some impressive tablet shipment figures. His claims are backed up by IDC’s latest reports.

Pichai said tablet sales by the end of the year should hit 225 million, with a total of 70 million Android tablet activations, up from 40 million last year, reports Slashgear.

However, Android is gaining ground on iOS and Pichai claims one in two new tablets is based on Android, not iOS.

This basically means tablets will start outselling PCs soon. Sales of corporate PCs won’t be as affected as sales of consumer PCs. Many consumers are apparently shunning their PCs and using tablets to perform basic tasks. Of course this doesn’t apply to users who use productivity applications on their computers.

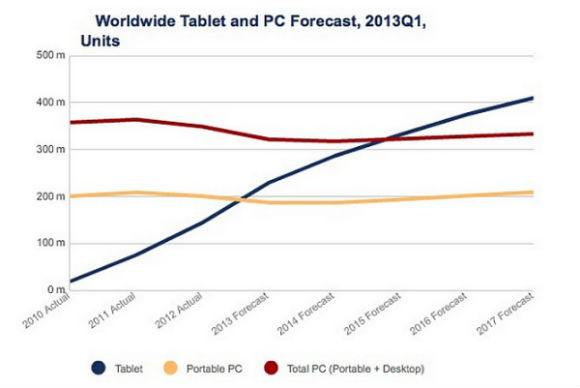

However, the PC market seems to be bottoming out. Tablet shipments should hit 300 million units by 2015 and 400 million units by 400, but PC sales should stabilise at current levels and start recovering next year.

Although tablets are disrupting the PC industry, the trend can’t go on for much longer. Over the next couple of years anyone who could completely replace their notebook with a tablet would have done so, hence PC shipments should remain relatively stable, although they’ll still be short of 2011’s record.

Interestingly, the forecasts don’t show any slowdown in tablet sales through 2017. As tablets mature, sales should start cooling down, but as things stand now, tablets still have a lot of potential for long-term growth.

The real question is how many tablets in 2015 and 2017 will be hybrids. Intel is pitching its 2-in-1 concept and PC vendors will be eager to embrace them. Hybrid tablets will effectively blur the line between tablets and ultraportable notebooks. If Intel has its way, much of that 400 million figure forecasted for 2017 will belong to hybrids.

However, we are not entirely convinced Intel and Microsoft can pull it off without sacrificing a few sacred cows in the process.