Sales of DRAM rose by 8.2 percent in the fourth quarter, bucking the usual pattern in the memory market.

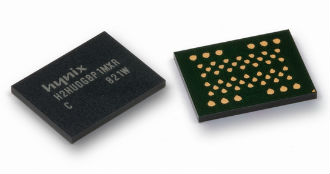

Sales of DRAM rose by 8.2 percent in the fourth quarter, bucking the usual pattern in the memory market.DRAM Exchange, which tracks the memory market said manufacturers of devices migrated fast to 20 and 25 nanometre production, and the additional output meant quarterly revenues worldwide amounted to $13 billion.

The firm said that Samsung has shown the most profit from making DRAM, with typical operating margins of 47 percent.

SK Hynix also makes healthy margins of 42 percent, while American DRAM maker Micron managed to turn in margins of 29.5 percent.

Although Micron is still manufacturing using 30 nanometre technology, it raised production of DRAM for servers, which is the most lucrative application.

Samsung started volume production on 20 nanometre in the fourth quarter and the yield rate and output of chips made at 25 nanometre has increased.

Micron has begun sampling on the 20 nanometre process but plans to migrate so fast that there will be 80,000 wafer starts a month by the end of this year.