The European PC market may be about to bottom out, but before it does several vendors will take massive hits, research from Gartner reveals. PC shipments in Western Europe totalled just 10.9 million units last quarter, down 19.8 percent year-on-year.

The European PC market may be about to bottom out, but before it does several vendors will take massive hits, research from Gartner reveals. PC shipments in Western Europe totalled just 10.9 million units last quarter, down 19.8 percent year-on-year.

Gartner concluded that the death of netbook PCs, inventory woes caused by the transition to Haswell and Windows 8.1 all played a role in the decline. Acer and Asus were particularly hard hit. Acer’s sales were down 44.7 percent, while Asus took a 41.7 percent plunge. Acer sold just 1.3 million boxes in Q2, down from 2.36 million in the same quarter last year. It faired a bit better in Britain, with a 21.4 percent drop. Asus managed 850,000 units, down from 1.45 million last year.

HP still leads the way with 2.28 million units and a 20.8 percent market share. Unlike Acer and Asus, it managed to maintain its market share, but overall shipments were down 17.4 percent compared to a year ago. Lenovo was the only big vendor to end the quarter on a positive note. It shipped 1.26 million units, up from 1.185 million last year. That was enough to boost its market share from 7.8 to 11.5 percent.

Dell also did relatively well. Although its shipments were down 1.1 percent to 1.17 million units, Dell upped its market share from 8.7 percent to 10.7 percent.

Although all segments of the PC market declined, notebook sales saw a 23.9 percent drop, while desktop sales declined 12.2 percent. The consumer market saw a 25.8 percent dip, while sales of professional rigs were down 13.5 percent.

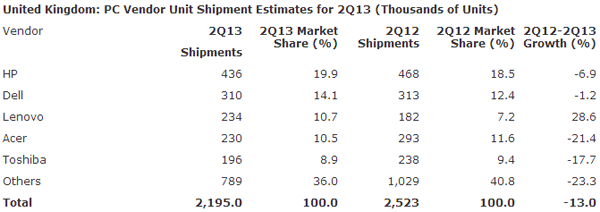

Gartner concluded that the UK mobile PC market lost 25 percent of its volume since 2010. PC shipments in Blighty totalled 2.2 percent units in Q1, down 13 percent from Q1 2012.

“The second quarter marked the 11th consecutive quarter of decline in the U.K.,” said Ranjit Atwal, research director at Gartner. “During this time the notebook market has shrunk nearly 25 percent in unit volume. The U.K. notebook market totaled over 2 million units in the second quarter of 2010 and has now reached just under 1.5 million units.”

Atwal said PC vendors are now at a “make or break point” in the industry, as the product move to new hardware and Windows 8.1 could turn things around. He also pointed out that the professional market did a lot better than the consumer market.

However, it looks like things will get worse before they get better.