Hard drive maker Seagate is planning a big push into the solid-drive market and now it seems to be making its first move. The company is hosting a job fair in Longmont later this week and it is looking to hire about 150 people, mostly engineers.

Hard drive maker Seagate is planning a big push into the solid-drive market and now it seems to be making its first move. The company is hosting a job fair in Longmont later this week and it is looking to hire about 150 people, mostly engineers.

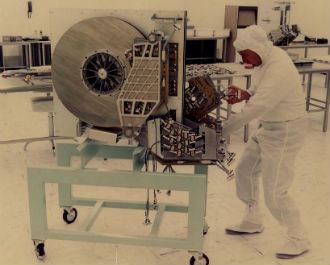

Seagate’s 1,250-strong Colorado Design Centre is based in Longmont and it seems it will lead Seagate’s SSD push. Gary Gentry, Seagate VP and general manager of the company’s SSD business, said his client SSD team will be headquartered in Longmont.

“We already have a substantial group and we’re expanding the technology, the product and the business development here in Longmont,” he told Timescall.com.

Seagate’s new 600-series SSDs will be marketed to consumers and OEMs alike, marking a new era in the company’s history. The drives will be available in multiple capacities up to 480GB and they will fit standard hard drive bays, which means we are probably looking at 2.5-inch 7mm units. In addition, Seagate also plans to develop a series of business oriented SSDs at Longmont.

This won’t be the first time Longmont dabbled in flash. The centre was instrumental in the development of Seagate’s hybrid drives (SSHDs) a couple of years ago. It got the job done and Seagate was the first hard drive market to successfully introduce 2.5-inch hybrids. Earlier this year it upgraded and expanded its SSHD offer.

Seagate VP and management lead for the centre Jeff Mason said his team is also developing drives specifically designed to suit the needs of large-scale cloud storage systems. He said the job fair is Seagate’s biggest recruitment in a decade and said the hiring will occur throughout the year.

Although Seagate is betting big on SSDs, it won’t leave the traditional HDD market anytime soon.

“There’s not enough SSD production in the world to replace the amount of storage that magnetic storage devices provide,” said Mason.

Mason pointed out that mobile devices are not a “displacer” for mechanical storage, but rather a stimulant, as mobile devices tend to rely on cloud storage, which is still largely based on mechanical drives.