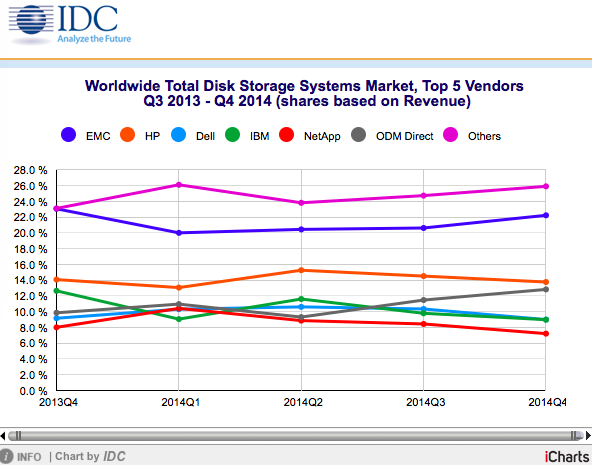

EMC and Dell have gone into overdrive in the expectation that the two companies will merge.

EMC and Dell have gone into overdrive in the expectation that the two companies will merge.

Sarah Shields, general manager of Dell UK, said that both companies had put senior members in place to work on the integration plans. She said that EMC products are complementary to Dell’s.

“The integration is a bit of a no-brainer,” she said. She said there are some obvious synergies and she herself was looking at the EMC programmes already in place.

“From our point of view it’s business as usual and so far it’s looking very positive,” she said.

She said that Dell shifted its business model to include the channel eight years ago, and although she declined to give figures, said channel business accounted for 40 percent of the company’s revenues.

She said that while business worldwide had been challenging last years, Dell had continued to grow. She said that both channel revenues and units were both positive.