US tech giant Qualcomm may face a fine of as much as $1 billion after antitrust regulators decide on its future.

US tech giant Qualcomm may face a fine of as much as $1 billion after antitrust regulators decide on its future.

US tech giant Qualcomm may face a fine of as much as $1 billion after antitrust regulators decide on its future.

US tech giant Qualcomm may face a fine of as much as $1 billion after antitrust regulators decide on its future.

A survey commissioned by Barclays’ Bank has revealed that UK IT firms are confident about profits during 2015.

A survey commissioned by Barclays’ Bank has revealed that UK IT firms are confident about profits during 2015. It is rare that a company claims to have control of Apple, but it seems that Intel believes that it has Jobs’ Mob wrapped around its little finger.

It is rare that a company claims to have control of Apple, but it seems that Intel believes that it has Jobs’ Mob wrapped around its little finger.

After ten years working with Apple, there are rumours that Jobs’ Mob is considering ditching Chipzilla and will start making its own Mac chips. After all Apple already creates its own chips for the iPhone and iPad based on designs from ARM and then has manufacturers like Samsung build them.

The Tame Apple Press thinks that eventually Apple’s ARM chips will be so powerful, Apple won’t need Intel anymore.

But in an interview with Business Insider, Intel’s CFO Stacy Smith brushed off those concerns and claimed that Intel is so far ahead of the competition when it comes to PC processors that Apple – and just about every other PC maker – has no choice but to use Intel chips.

Smith said that Apple was a “great partner of ours” and like Intel they like bringing really cool stuff to the market.

Intel’s leadership over the rest of the industry is extending. We’re not delayed relative to the industry. Intel is ahead of the industry, Smith said.

For Jobs Mob that means that if it abandons Intel it will have to lose lots of performance in its new Macs.

Intel thinks that Apple customers would have to take such a big step off performance if Jobs’ Mob abandoned Intel it is not worth it.

Of course, Smith fails to understand that if Apple decided to walk away from Intel, it would simply tell its customers its solution was better and the Tame Apple Press would agree with it. Apple has never been about performance, it has always been about the design and the Apple logo.

There have been howls of derision on the interwebs after it was revealed that ad-blocking browser Adblock Plus has been paid off by Google, Amazon, Microsoft, and Taboola.

There have been howls of derision on the interwebs after it was revealed that ad-blocking browser Adblock Plus has been paid off by Google, Amazon, Microsoft, and Taboola.

What appeared to have been a brilliant bit of software which kept adverts out of your browser, has turned into something of a debacle.

PC Mag said that that one digital media company, which asked not to be named, said Eyeo had asked for a fee equivalent to 30 percent of the additional ad revenues that it would make from being unblocked.

What this means is that all you need to do to make a bit of dosh is write an ad-blocking code, it does not even have to work that well, and show up at the Big IT companies and say: “That is a nice bit of advertising, it would be terrible if something happened to it” and collect your cheque.

PC Mag ummed and ahed about how advertising drives the free Web and sites were not staying in business long these days, but the fact that you have to pay people who write anti-advertising software to look the other way does strike us as the central part of the story.

What this means is that the big companies who can afford to pay, can run adverts while the smaller magazines will see their sites blocked. In short the big guys win and the little sites are stuffed.

Walkie-talkie and radio systems maker Motorola Solutions is looking into a possible sale.

Walkie-talkie and radio systems maker Motorola Solutions is looking into a possible sale.

According to Bloomberg, potential buyers could include private equity firms and defence contractors including Raytheon, Honeywell and General Dynamics.

The 87-year-old company is working with financial advisers as it looks for a buyer.

We are not holding our breath. The sale process has been going on for several months, and a deal isn’t on the immediate horizon.

Motorola was split up four years ago into Motorola Solutions and a handset unit after a campaign by billionaire Carl Icahn. The handset business was sold to Google which then sold most of it to Lenovo.

Things are not going that well for Motorola Solutions. It has poor earnings performance, with 2014 earnings dropping 33 percent as sales declined six percent. The outlook for this year remains stagnant — the company projects 2015 revenue will be flat to slightly lower.

In other words, Motorola probably should not have listened to Icahn. Lenovo is doing well with the bits of the company it bought and saw its bottom line grow because of its investment.

TSMC is set to invest US$15.8 billion in the Central Taiwan Science Park (CTSP).

TSMC is set to invest US$15.8 billion in the Central Taiwan Science Park (CTSP).

The outfit is set to start building its 18-inch wafer foundry in March which will apply the 10 nanometre manufacturing process with a target for mass production in 2017.

However the location of the plant, away from mainland China has raised an eyebrow or two.

Last year the BBC ran a yarn about how China’s labour unions were getting antsy at Apple’s broken promises on work conditions.

Apple’s response to the BBC’s report at the time was that it strongly disagreed: “We are aware of no other company doing as much as Apple to ensure fair and safe working conditions. We work with suppliers to address shortfalls, and we see continuous and significant improvement, but we know our work is never done.”

However, another news site in China is reporting that “in response to the growing criticism of Foxconn’s treatment of its employees, the company has invited its critics to visit its production bases to get a better understanding of its operations”. During the visit, the critics could also talk to the employees to hear their views,” Foxconn said.

But it is starting to look like another row is flaring up between Foxconn via the labour unions – this time it is about overtime. It seems that there has been a rash of suicides at its plant, and the unions are blaming them on the overtime.

So it does seem that Foxconn is avoiding any conflict with the Chinese unions getting in the way of its relationship with Apple by shifting its new plant to Taiwan.

British chip designer ARM has bought Dutch firm Offspark, which is an open source security software outfit.

British chip designer ARM has bought Dutch firm Offspark, which is an open source security software outfit.

It is all part of ARM’s cunning plan to make chips for the internet of things. It seems that the move by Intel to buy McAfee is starting to make some sense and ARM is seeing the wisdom of having inhouse security software.

Offspark’s PolarSSL technology is designed for sensor modules, communication modules and smartphones.

ARM said buying the group would add its security and software cryptography to its IoT platform, designed to link billions of devices online.

It is not clear how much ARM paid for the security outfit. ARM has promised that the technology will remain open source and will be made available to developers for commercial use.

It complements ARM’s Cryptobox technology of mbed OS that enables secure execution and storage.

Apparently ARM is to release mbed OS under an Apache 2.0 licence which will include mbed TLS, Thread, and other key technologies toward the end of 2015.

The release of mbed TLS 1.3.10 is now available under GPL and to existing PolarSSL customers on polarssl.org.

A report said that investigators into a hack at US healthcare firm Anthem are blaming the Chinese government for the breach.

A report said that investigators into a hack at US healthcare firm Anthem are blaming the Chinese government for the breach.

Disappointing shipment numbers for tablets last year are forcing vendors to contemplate their marketing navels and come up with new ideas.

Disappointing shipment numbers for tablets last year are forcing vendors to contemplate their marketing navels and come up with new ideas. After an ignominious end to the much hyped Google Glasses, it appears the company hasn’t abandoned the whole effort.

After an ignominious end to the much hyped Google Glasses, it appears the company hasn’t abandoned the whole effort.

The agency that is watching you watching me has been criticised for hiding how it shared data with the USA.

The agency that is watching you watching me has been criticised for hiding how it shared data with the USA.

Watchdogs for the US Securities and Exchange Commission are snuffling around the rump of a January 14 spike in trading in BlackBerry options that took place hours before Reuters reported that Samsung Electronics was in talks to buy the Canadian smartphone maker.

Watchdogs for the US Securities and Exchange Commission are snuffling around the rump of a January 14 spike in trading in BlackBerry options that took place hours before Reuters reported that Samsung Electronics was in talks to buy the Canadian smartphone maker.

One trade took place at 12:06 p.m. on that day, when there was a purchase of options with the rights to buy 200,000 shares of BlackBerry stock at a strike price of $10 a share.

In the afternoon, Reuters reported that Samsung had offered to buy BlackBerry for as much as $7.5 billion, valuing its stock at between $13.35 to $15.49 per share.

BlackBerry’s stock shot up 30 percent on the news meaning that someone was laughing all the way to the bank. If the buyer had been able to sell the options at that high they would have been able to make a profit of $490,000 on a $20,000 investment.

Both companies later denied they were in talks and BlackBerry’s shares tumbled. Reuters subsequently corrected its story to make clear that the discussions were between advisors.

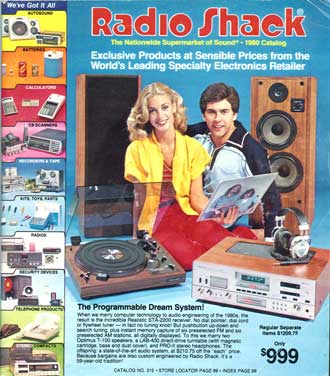

As we predicted, a century after it opened its first store and sent out its first catalogue, RadioShack (RSHC) has declared bankruptcy.

As we predicted, a century after it opened its first store and sent out its first catalogue, RadioShack (RSHC) has declared bankruptcy.

In its final hours it struck a deal to sell up to 2,400 of its approximately 4,000 stores and wireless company Sprint (S) will create a “store within a store” in up to 1,750 of those.

What is left will be shut.

RadioShack’s franchise locations, as well as stores in Mexico and Asia, are not included in any deals and it is not clear what their future will be.

RadioShack products, services and accessories will still be available at the approximately 1,750 stores where Sprint will open shop. In fact, Sprint will occupy just one third of those locations, where it will sell devices and plans.

The New York Stock Exchange (NYSE) suspended trading of Radio Shack shares on Monday. And RadioShack (RSHC)workers have told CNNMoney that some locations have already been converted to clearance stores.

Closing stores is expensive, due to the cost of redundancy, liquidating merchandise and paying penalties to get out of leases and the outfit has been too broke to close them.

Last March, the company wanted to close about 1,100 stores, but it was only able to close 175 stores through the end of October.

RadioShack has come a long way since the days it could brag about its vast retail network, saying that 90 per cent of Americans lived or worked within a few minutes of a RadioShack location.

Ironically, the Internet and Online shopping helped kill the outfit off – making all those stores an albatross.

RadioShack goes back to 1921, when it opened a store and mail-order operation in Boston to serve the needs of radio officers aboard ships. It was bought in 1963 by Tandy Corporation, a retailer that started as a supplier of leather parts to shoe repair shops.

RadioShack introduced one of the first mass-market personal computers, the TRS-80, in 1977, and one of the first laptops, the Model 100, in 1983. It also was an early seller of both mobile phones and satellite TV.