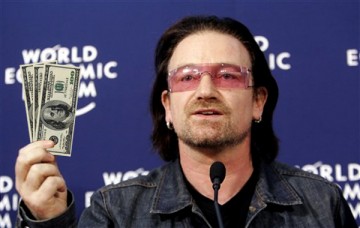

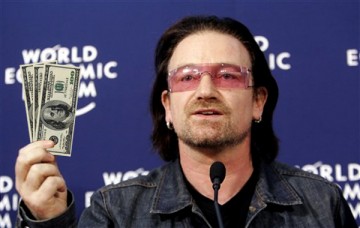

Suddenly it is hard to use the words “credibility” and “Bono” in the same sentence.

Suddenly it is hard to use the words “credibility” and “Bono” in the same sentence.

The U2 popular beat combo artist has done his best to champion all the right causes over the years. He has been a significant leader in the fight against poverty, and has helped to create the ONE Campaign, DATA, (RED) and EDUN, a clothing company which is striving to stimulate trade with poverty stricken countries. He has been nominated for the Nobel Peace prize three times for his efforts to help the poor.

This is why the U2 frontman stepping in to defend Apple’s method of screwing up the tax system of Europe is particularly hypocritical and nasty.

Bono is currently in a business partnership with Jobs’ Mob so having him stand up this weekend and defend Apple’s right to save a bob or two by shafting the health and welfare policies of the EU damaged any lefty street cred that the former 80s rocker might have had.

The U2 frontman believes large companies that avoid paying billions in taxes bring prosperity, rather than harm the economic growth of the country. Unfortunately, Bono, they do not.

Apple has paid an average tax rate of 2.5 percent over the past five years, despite turning over a profit of around $109 billion. This is a fraction of Ireland’s standard tax rate of 12.5 percent.

While Ireland was busy making its deals with big technology companies like Apple to act as a tax haven, the country was going through its biggest debt crisis ever. Apple might have provided jobs in Ireland, but its impact on the Irish economy has been minimal.

Bono said that Ireland was a tiny little country, which did not have scale, and our version of scale is to be innovative and to be clever, and tax competitiveness has brought our country the only prosperity we’ve known.

“We don’t have natural resources; we have to be able to attract people.”

Because of its generous tax allowances, he added, Ireland has reaped the benefits of “more hospitals and firemen and teachers because of the tax policies.”

Now this is a bit of rubbish from the bloke who was nominated for a Nobel Peace Prize in 2003 for his campaign to alleviate world debt. Tax avoidance schemes rarely help the economies of any nation and take away cash from countries that need the cash.

Ireland might not have attracted the likes of Jobs’ Mob, or Google, or other tax avoiders, but it would have had a fair taxation system. The other countries in the EU which Apple was avoiding paying tax would be able to afford betters health care standards, teachers and firemen.

The government’s IR 35 reform is going to seriously damage the IT industry according to Simon Winfield, UK and Ireland MD at global recruitment firm Hays.

The government’s IR 35 reform is going to seriously damage the IT industry according to Simon Winfield, UK and Ireland MD at global recruitment firm Hays.