NFC has been around in select high-end phones for years, and Google has included NFC support in every Nexus handset dating back to the Nexus S, which launched in late 2010. However, Apple and a few other names were not as keen to embrace it.

NFC has been around in select high-end phones for years, and Google has included NFC support in every Nexus handset dating back to the Nexus S, which launched in late 2010. However, Apple and a few other names were not as keen to embrace it.

Tag: m-commerce

Rich people prefer online shopping

Although there are thousands of penny pinching price comparison sites out there, it seems online shopping is pretty big among affluent consumers who really don’t need to save at all. According to research released by the Shullman Research Centre, the rich love to do their shopping online. Apparently they don’t want to mix with their serfs, for whatever reason.

Although there are thousands of penny pinching price comparison sites out there, it seems online shopping is pretty big among affluent consumers who really don’t need to save at all. According to research released by the Shullman Research Centre, the rich love to do their shopping online. Apparently they don’t want to mix with their serfs, for whatever reason.

The survey found that the vast majority of affluent consumers tend to research products online and make the purchase from an online device. Most of them still rely on desktops, at 64 percent, while tablets and smartphones are used by 18 and five percent respectively.

“I do not think luxury marketers are totally aware that [consumers] are using online for research and are getting comfortable buying that way,” said Bob Shullman, founder and CEO of the Shullman Research Center. He added that consumers enjoy convenience and that is exactly what online shopping is supposed to deliver.

To some extent it sounds a bit counter intuitive, as one would expect people to actually touch and feel upmarket merchandise before reaching for their credit card, but in reality just 10 percent of affluent consumers said they prefer researching in-store as opposed to online. Furthermore, 62 percent said they are comfortable using online services to buy stuff, while just 33 percent said they felt comfortable buying in person at a brick and mortar store.

However, rich people don’t shy away from mass marketed products, either. The survey found that 73 percent of them made purchases on Amazon in the past year, which means Amazon is the top service for rich folk and proles alike.

Smartphones improve in-store shopping experience

Although mobile commerce is still experiencing teething problems in most markets, a growing number of consumers are turning to smartphones to improve their shopping experience. Even when they are not making actual transactions, they are using their smartphones to learn more about products and services.

Although mobile commerce is still experiencing teething problems in most markets, a growing number of consumers are turning to smartphones to improve their shopping experience. Even when they are not making actual transactions, they are using their smartphones to learn more about products and services.

Google ditches physical card

Google is planning to revamp its Google Wallet digital payments platform at Google I/O. However, it seems plans for a physical credit card have been shelved, at least for the time being.

Google is planning to revamp its Google Wallet digital payments platform at Google I/O. However, it seems plans for a physical credit card have been shelved, at least for the time being.

According to AllThingsD, Google informed its staff that the card was ditched in a memo circulated after Google Wallet head Osama Bedier announced he is leaving the company.

However, although the card is history, Wallet is about to get a small revamp. Google will announce a number of changes at I/O, including an update to its rewards programme, more offers and loyalty points, along with the addition of more merchants.

Without a physical card though, Google Wallet will still rely solely on NFC technology, which hasn’t taken off yet. It was hoped that a proper card could push Google Wallet to the next level, but now it seems Google is rethinking its approach. Google doesn’t want to become a bank, or the next Visa. It wants to coexist with existing players and tap their vast infrastructure.

On the gossipy side, sources told AllThingsD’s Liz Gannes that Google CEO Larry Page pulled the plug on the card launch after he witnessed a glitchy demo last week. Apparently Page had long been sceptical of a physical card and the buggy demo was the last straw.

Authorize.Net lands in Blighty, Euroland

Payment gateway Authorize.Net is now available for British and European merchants, dealing in GBP, EUR and USD. Authorize.Net is a small business solution from CyberSource, a Visa company. It is a popular payment platform designed to accept and manage card transactions, fight fraud and automate recurring transactions.

Payment gateway Authorize.Net is now available for British and European merchants, dealing in GBP, EUR and USD. Authorize.Net is a small business solution from CyberSource, a Visa company. It is a popular payment platform designed to accept and manage card transactions, fight fraud and automate recurring transactions.

Simon Stokes, managing director EMEA at CyberSource, said the platform is now able to cater to merchants of all sizes throughout the UK, ranging from home-based start-ups to the biggest enterprise merchants. He was quick to point out that Authorize.Net is the most popular payment gateway in the US. Currently more than 380,000 merchants use Authorize.Net stateside.

“We believe UK merchants will benefit greatly from Authorize.Net’s stability, ease of use, and award winning support,” said Stokes.

In addition to bank card processing, Authorize.Net also provides merchants with a virtual terminal and a website payments seal. It also supports recurring billing, a suit of fraud detection filters and secure data storage. CyberSource also likes to point out that Authorize.Net’s customer support has received quality awards for four years running, so timely support shouldn’t be an issue.

Overseas online sales to soar to £28bn

According to research from OC&C Strategy Consultants and Google, British retailers could see their overseas online sales soar to £28 billion by the end of the decade.

According to research from OC&C Strategy Consultants and Google, British retailers could see their overseas online sales soar to £28 billion by the end of the decade.

Researchers concluded that growth in online sales will outpace domestic growth and eventually account for 40 percent of total online sales by 2020.

British retailers are already doing quite well abroad. In fact, international consumers spent £7.4 billion on British online retail sites last year, making up about 14 percent of total online sales. This year British retailers are expected to net £10 billion from cross-border sales.

OC&C Strategy Consultants and Google found that growth will come from multiple regions, with western Europea leading the way. Sales in western Europe are expected to hit £9.8 billion by 2020, up from £1.5 billion last year. Central and Eastern Europe will see plenty of growth as well, with sales reaching £6.9 billion by the end of the decade, up from £400 million last year.

Sales in Asia are expected to hit £4.5 billion by 2020, while North America will lose its position as the top market for British online retailers. The North American market is currently estimated at £800 million and it is set to expand to £2.7 billion in 2020. The American market is simply more mature than the rest of the world, which translates into slower growth.

“We have seen a significant increase in the volume of searches for British retailers and brands coming from overseas,” Peter Fitzgerald, director at Google, said. “The majority of non-UK searches are currently coming from Europe, followed by North America and Asia, driven by the increased popularity of British brands abroad. Retailers can use search data to identify pockets of demand and move quickly to meet the needs of customers.”

Anita Balchandani, partner at OC&C, said e-commerce has already transformed the retail game, which was once anchored in local markets.

“There are a number of reasons why growth in e-commerce is changing the rules of internationalisation. Firstly, geographical proximity no longer determines which market is best suited for expansion – the internet allows customers seek out the best offers from around the world,” she said. “Secondly, the nature of risk has changed. International expansion is much less capital intensive and this is creating growth opportunities which have a more controlled exposure to risk. Thirdly, the speed with which companies expand has also accelerated – over 40 of Britain’s top-100 etailers serve customers in more than 40 countries.”

SMBs throw cash about

Small and medium businesses are hiring dedicated e-commerce specialists in ever growing numbers.

Small and medium businesses are hiring dedicated e-commerce specialists in ever growing numbers.

According to a report from Freelancer.co.uk, SMBs are realizing that they need to offer safe and convenient online services, on par with the big boys. The number of businesses hiring e-commerce experts has gone up 19 percent in the first quarter of 2013.

Freelancer spokesman Matt Barrie stressed that the high street is already facing major problems due to the e-commerce boom. He warned that plenty of major retailers have already seen their businesses disintegrate because they lacked a good online presence. Smaller outfits seem to have learned their lesson, so they are investing in e-commerce in the hope of not becoming the next Jessops or HMV.

Barrie believes that even the biggest high street players could see their businesses go down the drain if they fail to embrace online shopping. It could be good news for smaller companies, as e-commerce could level the playing field and allow them to compete with bigger outfits, without much overhead. The web allows small companies to offer their goods and services to a much larger audience, so it could be used to their advantage.

Another aspect of the e-commerce revolution involves niche markets. Although they are diluted across the country, geography simply isn’t a limiting factor in e-commerce, which means that even tiny companies can cater to the entire niche market.

“Retail outlets are proving incapable of adjusting to a consumer base no longer geographically captive. E-commerce is dominating the consumer retail landscape,” said Barrie. “It’s no surprise that big name retailers that haven’t kept up with the online shopping revolution are increasingly going bankrupt. These high street dinosaurs are unwilling to compete, and so will soon be consigned to retail history.”

Big retail chains have all but monopolized the high street in recent years, but it seems e-commerce has the potential to reverse the trend and put independent retailers back on the map.

M-commerce continues to wow shoppers

M-commerce is continuing to grow in the retail space, a report has suggested.

M-commerce is continuing to grow in the retail space, a report has suggested.

In its Online Retail Index IBM said that the new way to spend money has been growing in popularity with smartphone owners opting to use this over traditional means of shopping.

According to the report, mobile commerce grew by 31 percent in the first quarter of this year, up from the same time in 2012. It said the technology now accounted for 17.4 percent of all online retail sales. The figures were also up from 13.3 percent in the year-earlier period.

IBM said that the trend had grown as a result of many shoppers liking the freedom m-commerce offered, enabling them to shop more frequently and, in some cases, spend more money. It also pointed out that the growth of interactive technologies, such as augmented reality and QR codes, which offered discounts for shoppers using m-commerce sites, had helped boost the adoption of mobile commerce.

And tablets have also fuelled the shopping frenzy, with IBM noting this technology’s larger screens, navigation and easier touch functions made online shopping easier.

IBM said that the growth would continue as a result of retailers embracing the trend and offering their customers sites that catered for m-commerce.

US mums move to m-commerce

US mums looking for an easy way to shop have become some of the broadest adopters of m-commerce, research by Alliance Data Retail Services has found.

US mums looking for an easy way to shop have become some of the broadest adopters of m-commerce, research by Alliance Data Retail Services has found.

However, mums in the UK have disagreed, citing security and fiddly smartphones as prevention for taking up this shopping method.

According to the credit card program provider more mums than ever are using m-commerce to help to be able to shop more efficiently in order to be able to keep up with their busy lives. It pointed out that mums who want to shop and not drop will frequently do so over m-commerce as opposed to having to drive to a store to make a purchase.

Among the respondents, 29 percent of mums said that the primary reason that they chose their smartphones for shopping was due to the speed and ease of the process.

Others used m-commerce to search for promotions and vouchers as well as finding the cheapest branded products.

However, over in the UK, the uptake of this technology is less. In a quick survey of 60 mums, 70 percent said they wouldn’t choose this method of shopping.

One told ChannelEye: “The method doesn’t seem secure. If I’m at home then I’ll feel safer as I’ll be using my own wi-fi but if I’m out it’s a no go. Therefore I might as well just log on using my laptop, which has a bigger screen and is less fiddly.”

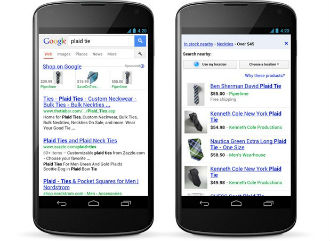

Retail search volumes on mobile gear skyrocketing

According to the latest BRC figures, total retail search volumes grew 16 percent in the first quarter of 2013 compared to a year ago. However, search volumes on mobile devices are skyrocketing. Growth on smartphone devices is estimated at 66 percent, while the volume of searches coming from tablets grew by a staggering 198 percent.

According to the latest BRC figures, total retail search volumes grew 16 percent in the first quarter of 2013 compared to a year ago. However, search volumes on mobile devices are skyrocketing. Growth on smartphone devices is estimated at 66 percent, while the volume of searches coming from tablets grew by a staggering 198 percent.

The numbers should come as no surprise, as the high street had a rather miserable quarter and quite a few consumers chose to do their shopping online. The horrible weather also had a lot to do with it.

Helen Dickinson, Director General, British Retail Consortium, said the figures confirm tablets and smartphones are becoming increasingly integral to the shopping experience for many consumers.

“It’s easier than ever to compare prices and products online, and retailers are continuing to invest in their websites and their ‘omnichannel’ offer so that customers have choice, convenience and flexibility when they shop,” said Dickinson. “The retail search data also closely mirrors the sales performance across different categories in March. It’s clear that the prolonged cold snap held many of us back from both browsing and buying new-season clothing lines until some sunshine arrived.”

Google Retail Director Peter Fitzgerald described the results as a “strong start to the year,” pointing out that retail queries grew by 16 percent year-on-year.

“This growth continues to be fuelled by the multi-device trend we are experiencing. Tablet queries grew nearly three times compared to the same period last year, whilst mobile traffic grew at 66 per cent,” he said.

Fitzgerald said the positive trend is set to continue into 2013, as more and more users embrace multiple smart devices. He also added that British brands did relatively well overseas, with searches up 16 percent across the globe and 75 percent in America.

Marks & Spencer kicks off mobile payments trial

Marks & Spencer has launched a small pilot program to test its new mobile payments service. The M&S Digital Lab app was launched in February and Marks & Spencer says it will help it explore emerging technologies and understand how they might work.

Marks & Spencer has launched a small pilot program to test its new mobile payments service. The M&S Digital Lab app was launched in February and Marks & Spencer says it will help it explore emerging technologies and understand how they might work.

However, the new mobile payments service is not actually a part of the m-commerce app. It is merely an element of Marks & Spencer’s overall marketing and technology campaign, reports QR Press Codes. Marks & Spencer is using a third-party app to try out its new service.

The Paddle app was developed by a London based startup and it is supposed to be leaner and easier to use than competing solutions. The app sorts out transactions by scanning QR codes and developers claim it is very secure.

The information is transmitted in the cloud, the credit card information and delivery address need to be submitted only once. Only the last four digits of the card must be submitted to validate the purchase, which should speed up transactions and improve security.

Mobile commerce set to explode in 2013 and beyond

Mobile commerce is slowly but surely going mainstream and a recent report from BI Intelligence found that m-commerce spending will skyrocket over the next couple of years.

Mobile commerce is slowly but surely going mainstream and a recent report from BI Intelligence found that m-commerce spending will skyrocket over the next couple of years.

The mobile boom is changing shopping habits, and fast. Consumers are using their shiny new smartphones and tablets to redeem coupons, research products, compare prices and, of course, pay for stuff both online and offline.

The trend has not gone unnoticed by major outfits and it is easy to see why, there are plenty of opportunities for just about every consumer oriented industry. The BI Intelligence report found that 29 per cent of US mobile users have already made purchases on their smartphones. Mobile sales accounted for 6.6 per cent of Cyber Monday e-commerce sales in 2011, up from just 3.9 per cent in 2010.

Bank of America now estimates that US and European shoppers will spend $67.1 billion using their smartphones and tablets.

Aside from huge revenue opportunities, mobile commerce has a few other things going for it as well. It is believed that mobile payments can create a more direct link between brands and consumers, with more coupons and loyalty reward programmes.

BI also concluded that the nature of mobile commerce makes it uniquely attractive to marketers, with technologies such as location targeting and in-store mobile marketing.

M-commerce survey reveals strong growth

A survey carried out by Stibo Systems has revealed that the number of m-commerce purchases has increased by 19 per cent over the last year.

A survey carried out by Stibo Systems has revealed that the number of m-commerce purchases has increased by 19 per cent over the last year.

The study found that the number of purchases made over e-commerce increased from 40 per cent to 59 per cent in 12 months. However, the survey also established that 17 percent of consumers aren’t too keen on m-commerce channels when they can’t find the necessary information using their tablet or mobile.

Finding product info using a smartphone should be relatively straightforward, but 48 per cent of respondents said small screens make it very hard to read information once it has been found. In other words, m-commerce outfits should start using bigger fonts. Another 46 per cent said they are still concerned about security, reports QRcodepress.

SEO Positive exec Ben Austin said the ever evolving smartphone and tablet market is making mobile purchases much easier than before. The added level of convenience has managed to attract more consumers, but more work needs to be done.

“This research also highlights the need for the information on mobile sites to be clear and secure,” he said.

The industry needs to do more to address security concerns, which are overblown as it is, and they apparently need to redesign their mobile shopping sites to improve readability on small screens. The latter part sounds easy enough, but strengthening confidence in mobile security might prove a bit more challenging.

E-commerce generates demand for mega-warehouses

Online shoppers are not just killing main street, they seem to be taking creating a lot of demand for oversized commercial storage units suitable for logistics and delivery outfits. In other words, small warehouses are going out of style, fast.

Online shoppers are not just killing main street, they seem to be taking creating a lot of demand for oversized commercial storage units suitable for logistics and delivery outfits. In other words, small warehouses are going out of style, fast.

Property Magazine International reports that 25 million square meters of retail space will be needed over the next five years to keep up with e-commerce trends. That is the equivalent of 3,300 football pitches and some developers might end up driving white Bentleys, just like Premiership footballers.

It is estimated that online outfits will also need an additional three million square meters of specially equipped e-fulfilment space over the next five years. Another 22 million square meters is needed to keep retail stores and satellite warehouses stocked.

The growth of e-commerce will also drive further development of so-called dark stores, which is basically a fancy name for huge warehouses where goods are packed and shipped to consumers.

Jones Lang LaSalle executive Paul Betts argued that many retailers have simply outgrown their supply chain infrastructure and they have to work out new logistics models for multi-channel retail.

M-commerce to double in next 12 months

Mobile shopping is the new black and a recent survey carried out by Conlumino indicates that it will continue to grow at an impressive rate for the foreseeable future. M-commerce has already risen 55 percent compared to a year ago and it is now estimated that it will grow another 115 percent over the next 12 months.

Mobile shopping is the new black and a recent survey carried out by Conlumino indicates that it will continue to grow at an impressive rate for the foreseeable future. M-commerce has already risen 55 percent compared to a year ago and it is now estimated that it will grow another 115 percent over the next 12 months.