According to an analyst note from Carnegie, world chip sales are likely to be largely untouched between the June to July – at one percent seasonally adjusted month by month – and $24.9 for the month.

According to an analyst note from Carnegie, world chip sales are likely to be largely untouched between the June to July – at one percent seasonally adjusted month by month – and $24.9 for the month.

A May spike could have been thanks to Samsung’s latest Galaxy handsets, but a drop in June could be down to clearing previous inventories of previous phone and PC models ahead of new launches.

Carnegie’s early indicator for the three month moving average of chip sales for July suggests a “modest improvement slightly better than the normal seasonal pattern”.

Korean chip exports were better throughout July and August compared to June levels. Other tech production in South Korea was on the up after a long slump post the Q4 iPhone and iPad boom.

Taiwanese production improved over July thanks to electronic components and parts, however, overall it was held back by a weakness in high end smartphones and a drop in TV manufacturing.

Japan has been losing market share in semiconductors to other countries in the APAC region, in particular China and Vietnam. A sharp drop in chip segments was noted for Japan, with Carnegie adding an overall drop in Japanase consumer electronics market share and less production in Japan likely contributed.

Carnegie estimates world semiconductor sales will drop by one percent for the year.

Carnegie warned that US PC imports have been weak since March – and that the numbers could include tablet computers. Meanwhile, retail sales are sluggish for tech categories. Some of this is attributed to shopping patterns, as internet sales replaced buying through brick and mortar stores.

US inventory levels for electronics fell sharply, with leading retailers like Best Buy slashing their stock.

For the US telecom enterprise sector, it is expected that imports are flat, including Ericsson and Cisco equipment. Although the July numbers are not in, May and June imports were weak after a spike in April.

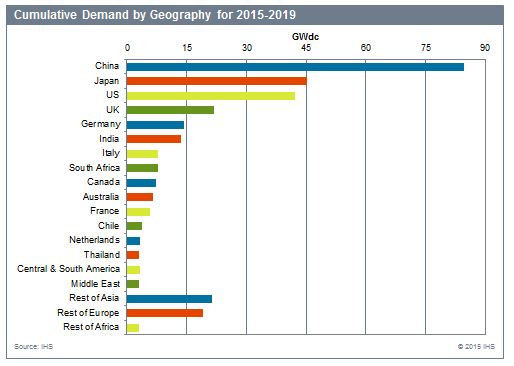

A report said that total global solar photovoltaic (PV) capacity will be 498 gigawatts in 2019, a 177 percent increase over capacity in 2014.

A report said that total global solar photovoltaic (PV) capacity will be 498 gigawatts in 2019, a 177 percent increase over capacity in 2014.