Cloud channel members should be rubbing their paws with glee at the news that cloud spending is on the increase

Cloud channel members should be rubbing their paws with glee at the news that cloud spending is on the increase

IDC has increased its forecasts for the amount of cloud infrastructure sales that will be sold globally this year on the back of a solid showing in the second quarter.

The analyst house has charted a 48.4 percent increase in the sale of infrastructure products, including servers, storage and Ethernet switches, sold by vendors and fulfilled by the channel in Q2. As a result, the forecasts for the full year are now coming in a $62.2 billion, an increase of 31.1 percent on last year.

Spending is increasing in public and private cloud areas, up by 58.9 percent and 28.2 percent in Q2 respectively, with the combined investments in cloud infrastructure now accounting for almost half of all the infrastructure spending globally.

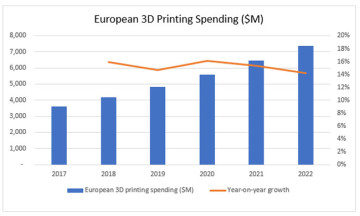

IDC is forecasting that spending in cloud environments is going to grow by double digits this year.

Non-cloud IT is dying, and it still accounted for just over half of the total infrastructure market in Q2 and came in with 21.1 percent growth, but it is markedly lower than cloud-related spending.

Natalya Yezhkova, research director, IT Infrastructure and Platforms at IDC said that as the share of cloud environments in the overall spending on IT infrastructure continues to climb and approaches 50 percent, it is evident that cloud, which once used to be an emerging sector of the IT infrastructure industry, is now the norm.

“One of the tasks for enterprises now is not only to decide on what cloud resources to use but how to manage multiple cloud resources. End users’ ability to use multi-cloud resources is an essential driver of further proliferation for both public and private cloud environments”, she added.

The top three regarding market share were Dell, HPE and Cisco. But the shining star regarding revenue growth year on year in Q2 was Lenovo, which delivered a 223.5 percent increase putting it in fourth place.