Smartphone sales are up again, but growth is slowing. The worldwide market gobbled up 435 million phones in the second quarter, up 3.6 percent over the same period last year. However, worldwide smartphone sales have now reached 225 million units, up 46.5 percent from a year ago.

Smartphone sales are up again, but growth is slowing. The worldwide market gobbled up 435 million phones in the second quarter, up 3.6 percent over the same period last year. However, worldwide smartphone sales have now reached 225 million units, up 46.5 percent from a year ago.

It was only a matter of time before smartphone shipments outpaced feature phone shipments and according to Gartner, this happened last quarter. Feature phone, or dumb phone shipments totalled just 210 million units, down 21 percent year-on-year.

“Smartphones accounted for 51.8 percent of mobile phone sales in the second quarter of 2013, resulting in smartphone sales surpassing feature phone sales for the first time,” said Anshul Gupta, principal research analyst at Gartner. Asia/Pacific, Latin America and Eastern Europe exhibited the highest smartphone growth rates of 74.1 percent, 55.7 percent and 31.6 percent respectively, as smartphone sales grew in all regions.

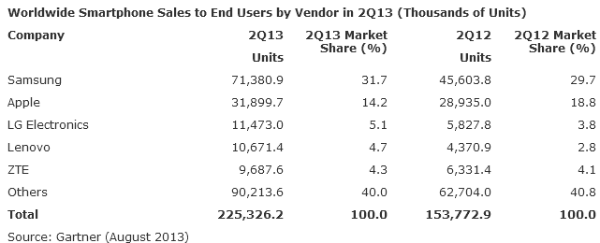

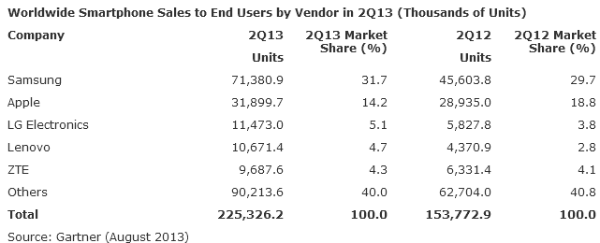

Samsung still reigns supreme, with 71.4 million units shipped last quarter and a 31.7 percent market share. Apple ranks second with 31.9 million units, but it is losing market share fast. LG and Lenovo had a very good quarter, shipping 11.5 and 10.6 million smartphones respectively. ZTE ranked fifth with 9.7 million units. Nokia, HTC, Blackberry and Sony are no longer in the top five. However, the top five vendors accounted for just 60 percent of the market, while 40 percent went to smaller outfits, including an ever increasing number of Chinese white-box manufacturers.

Gartner found that much of Samsung’s demand is now coming from mid-tier products and high-end devices with ASPs up to $400. It concluded that Samsung needs to do more to make its mid-range offering more appealing. Oddly enough Apple also saw a dip in ASP, which is currently at the lowest level since 2007. This is the result of surprising strong sales of the iPhone 4 in some markets. Apple has recognized the trend and it plans to introduce a new, cheaper iPhone next month.

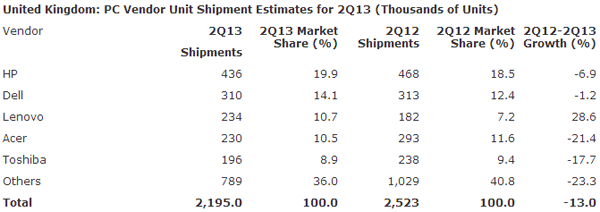

But Lenovo is the name to look out for. It’s making a killing in the dreary PC market and it’s doing even better in smartphones, although much of its effort goes unnoticed in the west. Lenovo almost doubled its share over the last 12 months and the company plans to bring its smartphones to western markets soon, possibly even next year.

Android remains the dominant operating system, with a 79 percent share, up from 64.2 percent a year ago. Apple’s iOS ranks second with a 14.2 percent share, down from 18.8 percent in Q2 2012. Microsoft gained some ground, but Windows Phone 8 still has a tiny share, 3.3 percent, up from 2.6 percent last year. Blackberry’s share halved to 2.7 percent and the Canadian company is now looking for a buyer. As with all things Blackberry, the decision comes three years too late.

Crystal ball readers at analyst outfit Gartner have seen a future where robots and drones replace a third of all workers by 2025.

Crystal ball readers at analyst outfit Gartner have seen a future where robots and drones replace a third of all workers by 2025.