Specification-led marketing and product data specialist, SpecifiedBy, has reported substantial quarterly growth in its online marketplace as COVID-19 building product manufacturers embrace digital transformation.

Specification-led marketing and product data specialist, SpecifiedBy, has reported substantial quarterly growth in its online marketplace as COVID-19 building product manufacturers embrace digital transformation.

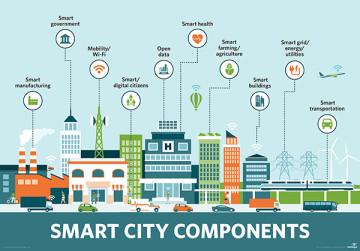

The Newcastle-headquartered company, whose clients include Dyson, VELUX, Tarmac and SIG, has seen a 125 percent increase in manufacturers signing up to its platform between April and June 2020, compared to the same period last year. During this time, traffic to the platform has also increased by 60 percent as architects and specifiers are among the professions that have moved more of their work online during the pandemic.