The days of Apple and Google screwing over European and American tax authorities by having an Irish base is likely to become a thing of the past.

The days of Apple and Google screwing over European and American tax authorities by having an Irish base is likely to become a thing of the past.

Ireland’s Ministry of Finance announced that Ireland will phase out its controversial tax scheme known as the “Double Irish,” which lets companies, especially tech companies, drastically reduce their overseas tax burden.

Irish Finance Minister Michael Noonan said in a statement accompanying the government’s new 2015 budget that he was abolishing the ability of companies to use the ‘Double Irish’ by changing our residency rules to require all companies registered in Ireland to also be tax resident.

This change will take effect from the 1st of January 2015 for new companies. For existing companies, there will be provision for a transition period until the end of 2020.

So, in other words, Apple and Google will be able to save money for at least six years.

Firms that take advantage of this arrangement include Apple, Amazon, Adobe, Microsoft, and Google. It is unlikely that they will move their EU operations away from Ireland as the corporation tax rate in that country is extremely low.

Google declared $60 billion worth of revenue in the United States in 2013. Google’s effective tax rate in the United States has fallen dramatically from 21 percent to 15.7 percent in recent years as the company has broadened its use of overseas tax benefits.

It is starting to look like the Irish government was getting a little jittery about an EU investigation into the scheme. Over the last year, various European countries, including the United Kingdom, the Netherlands, and France, have been reviewing their laws that enable this type of corporate behaviour.

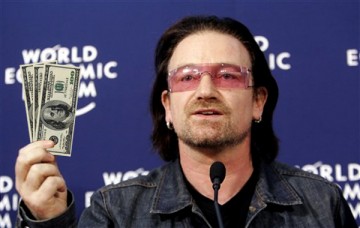

Noonan is going against U2’s Bono, the Irish icon, who claimed that the fact that Apple’s cheating of the tax payer in the US and EU somehow assisted Irish poor. To be fair Bono owes Apple a favour – Jobs’ Mob forced Apple fans to listen to U2’s latest album by hard wiring it into the latest iPhone 6, until it had enough complaints to issue a fix for the problem.