Shipments of budget smartphones are expected to see significant growth over the next five years, a report from ABI Research has found.

Shipments of budget smartphones are expected to see significant growth over the next five years, a report from ABI Research has found.

Low cost smartphones are defined as smartphones with a wholesale ASP below $200 and they are making significant inroads in OEM and carrier portfolios in emerging markets.

ABI expects shipments of such frugal smartphones to reach 238 million units. However, as emerging markets start to enter the fray, shipments will hit 758 million by 2018. Smartphone penetration in emerging markets, including BRIC countries, remains relatively low, so there is plenty of room for growth.

“Despite the low cost moniker, research has shown that the feature gap between low- and high-end smartphones is decreasing, making low cost smartphones a ‘good enough’ solution for price sensitive consumers in all markets,” says senior analyst Michael Morgan.

Oddly enough, big players don’t appear to be capitalizing on the trend. Much of the growth is coming from regional and Chinese OEMs, capable of delivering dual and quad-core phones below the $200 mark. Qualcomm is practically the only big name in the mobile industry to design a series of chips and reference designs for such phones. MediaTek is taking a similar approach and it’s making big gains.

However, cheap smartphones aren’t reserved for developing countries. Although most carriers and retailers in the west tend to place an emphasis on high-end devices, many users are going after cheap smartphones.

“We are increasingly seeing low cost smartphones appear as a solution for prepaid operators in developed markets,” adds senior practice director Jeff Orr. “By 2018, ABI Research believes low cost smartphones will account for 44 percent of all smartphone shipments as the market looks to capture the next billion smartphone users.”

Low cost OEMs like Alcatel, Huawei, ZTE and CoolPad stand to make a pretty penny on the trend, along with countless white-box outfits in mainland China.

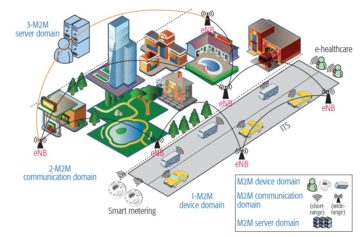

Massive Machine Type Communication (mMTC) designed to provide a cheap and robust simultaneous connection to billions of devices and modules over wired or wireless networks without overloading the network, could be the next big thing according to global tech market advisory firm, ABI Research.

Massive Machine Type Communication (mMTC) designed to provide a cheap and robust simultaneous connection to billions of devices and modules over wired or wireless networks without overloading the network, could be the next big thing according to global tech market advisory firm, ABI Research.