New numbers from the Gartner Group show that Dell has beaten HPE to the top spot for server shipments.

New numbers from the Gartner Group show that Dell has beaten HPE to the top spot for server shipments.

To be fair, though, the market shrank and worldwide server revenue is down 0.8 percent. Shipments are up by two percent which means that there is some pretty nasty price cutting going on.

Everywhere except for Asia/Pacific and North America is in decline, though shipments in those areas grew by 5.6 percent and three percent respectively.

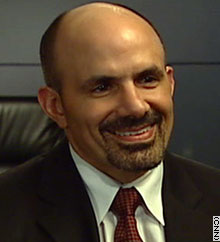

Jeffrey Hewitt, research vice president at Gartner said: “Dell garnered 19.3 per cent of the market and moved into the No. 1 position in worldwide server shipments due primarily to growth resulting from programmes it has in place in the Asia/Pacific region, most notably in China. However, HPE continued to lead the x86 market in revenue with 26 per cent of the market.”

He added: “x86 servers grew 2.1 percent in shipments and 5.8 percent in revenue in the second quarter of 2016.”

Dell’s strong performance did not see its revenues match the growth. HPE continues to hold more of the market share in revenue though that contracted by 6.4 percent year-on-year, while Dell saw almost 10 percent growth.

IBM’s server revenues dropped by 34.4 percent but then it did flog its business to Lenovo.

HPE’s shipments also contracted year-on-year, shrinking by more than 18 percent, while Dell, Lenovo, Huawei, Inspur and others pulled up their socks.