While most channel partners might not be too interested in AI trends, Salesforce has a cunning plan to use the concept to spice up its partner relationship management software.

While most channel partners might not be too interested in AI trends, Salesforce has a cunning plan to use the concept to spice up its partner relationship management software.

Salesforce’s PRM software, which is delivered as a service, uses an Einstein AI engine that the software outfit thinks could change the way the channel is run.

At the moment, PRM applications are loaded with data about customer transactions, but sorting through all that data to make the best optimal decision is laborious. Einstein is supposed to instantly identify what combination of products and services will, for example, yield the most profit for them.

Channel management teams can identify what partners make the best use of marketing development funds (MDFs) or have higher customer satisfaction ratings with a specific product or technology.

This means that the vendor can better identify when a customer is most likely to upgrade an existing product or service.

While this will not mean the end of the days where a nice lunch would improve vendor standing, it will mean that sales teams will come to the table with some good facts about what the client wants.

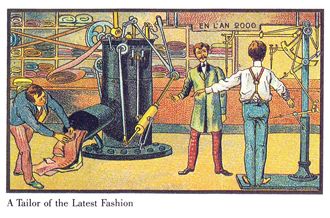

The technology is still limited AI technologies start to cut both ways in the channel. Instead of a PRM application, there will inevitably be a vendor relationship management (VRM) application infused with AI capabilities. Solution providers would then be able to instantly compare which vendor in a category, such as servers and storage, is providing them with the best deal at a given time.