Beancounters at Gartner have added up some numbers and divided them by their shoe size and worked out that the top ten OEMs increased their chip spending by more than 25 percent last year.

Beancounters at Gartner have added up some numbers and divided them by their shoe size and worked out that the top ten OEMs increased their chip spending by more than 25 percent last year.

The big 10 accounted for 42.1 percent of the total market in 2021.

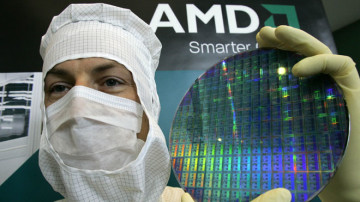

The price increase spending was due to global shortages which “prevented OEMs from increasing in production” and “significantly increased selling prices”, Gartner said.

Its preliminary research found that average selling prices of semiconductor chips increased by 15 percent or more in 2021.

“Semiconductor vendors shipped more chips in 2021, but the OEMs’ demand was far stronger than the vendors’ production capacity,” said Masatsune Yamaji, research director at Gartner.

“The semiconductor shortage also accelerated OEMs’ double booking and panic buying, causing a huge spike in their semiconductor spending.”

Apple spent $68.3 billion on semiconductors last year, up 26 percent from $54.1 billion the year before.

Meanwhile, Samsung’s chip spending rose 28.5 percent to $45.8 billion and Lenovo’s jumped 32.9 percent to $25.3 billion to complete the top three spenders.

Dell came in at fifth with $21.1 billion, while HP was seventh with $13.8 billion.

Overall, chip spending hit $583.5 billion, Gartner estimates, up from $466.2 billion the year before.