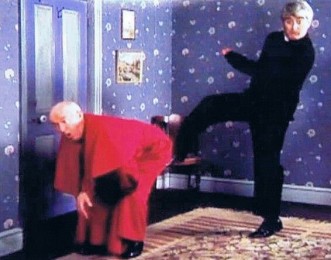

Tech Data has said it is countering the slowdown in IT spending across Europe by kicking its rivals in the market share.

Tech Data has said it is countering the slowdown in IT spending across Europe by kicking its rivals in the market share.

It did not say which rivals it has been targeting but it is pretty likely to be Ingram Micro. The results appear to have netted the outfit a a a general one percent rise in the first quarter.

The IT distie titan reported group sales of $6 billion. In the Americas that figure was $2.4 billion and a two percent rise . European sales were $3.6 billion and up one per cent.

CEO Bob Dutkovsky told analysts on a conference call that its teams made the most of “pockets of demand and delivered above market sales growth”.

Dutkovsky said that the cunning plan in the Americas was based around the “right mix of business, gained select market share” and “deselected less profitable business.” The US team has moved technical and field sales folk to higher growth areas of cloud, supply chain and unspecified services.

In Europe data centre related kit sales stumbled and there was a “sharp decline” in mobility products. Notebooks, tabs, software, consumer electronics and security business picked up the slack.

Tech Data isrumoured to be putting together a stand-alone security business unit across many ountries and it is believed to be centred in the UK.

Dutkovsky said it had swiped share from rivals but added that Dell opening up more business to the channel had helped and that market share gains don’t just come at the expense of the competitors.

He did not say if he was dancing on Ingram Micro’s grave. The outfit is being bought by Chinese conglomerate HNA Group and saw European sales which were pants.

Gross profit was $298.8 million which was $6.7 million higher than last year due to the sales increase. Gross margin was up by five basis points to 5.1 per cent and a richer mix of higher margin stuff was at play here.

Operating expenses jumped to $246 million from $209 million. This was helped by a $38.5 million settlement from LCD vendors for price fixing that was paid to Tech Data in the first quarter. This caused a drop in operating profits, which slipped to $52.5 million from $81.9 million.