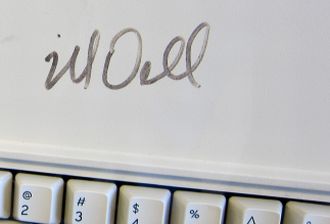

Tinbox supremo Michael Dell and buyout partner Silver Lake may well be reaching a deal with Dell’s special board committee to increase the price they’d pay – as long as the voting rules are tinkered with to make sure they win.

Tinbox supremo Michael Dell and buyout partner Silver Lake may well be reaching a deal with Dell’s special board committee to increase the price they’d pay – as long as the voting rules are tinkered with to make sure they win.

People familiar with the matter told the WSJ that Dell’s new deal isn’t done yet but if it were to go through, the per-share price would be bumped up from $13.65 to $13.75, as well as include a special dividend for shareholders.

The vote is set for today. But if Dell and Silver Lake successfully convince the committee to modify the voting rules, the shareholder vote could be staggered by as long as one month.

According to the WSJ, the change to voting rules would make it so only shares that are actually voted count. As it stands, abstentions count as a “no”.

It is possible with a change to the rules the deal could well pass. But it will upset top shareholders such as Carl Icahn, himself gunning for control over Dell, who started dragging Dell through the courts as of yesterday about the change.