Where once the global flat panel industry focused on unit growth, it appears that it is now taking a bigger interest in area demand.

Where once the global flat panel industry focused on unit growth, it appears that it is now taking a bigger interest in area demand.

Where once the global flat panel industry focused on unit growth, it appears that it is now taking a bigger interest in area demand.

Where once the global flat panel industry focused on unit growth, it appears that it is now taking a bigger interest in area demand.

The Supreme Court of India today ordered Microsoft, Google, and Yahoo not to carry adverts for products that will predict the gender of a child.

The Supreme Court of India today ordered Microsoft, Google, and Yahoo not to carry adverts for products that will predict the gender of a child. Big Blue said it has announced a cloud technology that will help ordinary people protect themselves online.

Big Blue said it has announced a cloud technology that will help ordinary people protect themselves online.

Chip giant Intel is being stubborn about its mobile strategy and will continue to throw money at the problem.

Chip giant Intel is being stubborn about its mobile strategy and will continue to throw money at the problem.

Financial analysts on Wall Street yesterday gave credence to rumours that Advanced Micro Devices (AMD) is up for sale.

Financial analysts on Wall Street yesterday gave credence to rumours that Advanced Micro Devices (AMD) is up for sale.

Security experts at Kaspersky Lab have discovered shared code and functionality between the Regin malware and a similar platform in a newly disclosed set of Edward Snowden documents 10 days ago by Germany’s Der Spiegel.

Security experts at Kaspersky Lab have discovered shared code and functionality between the Regin malware and a similar platform in a newly disclosed set of Edward Snowden documents 10 days ago by Germany’s Der Spiegel.

The link, found in a keylogger called QWERTY allegedly used by the so-called Five Eyes, leads them to conclude that the developers of each platform are either the same, or work closely together.

Writing in their blog, Kaspersky Lab researchers Costin Raiu and Igor Soumenkov said that considering the extreme complexity of the Regin platform there’s little chance that it can be duplicated by somebody without having access to its source codes.

They think that the QWERTY malware developers and the Regin developers were the same or working together.

The Der Spiegel article describes how the U.S National Security Agency, the U.K.’s GCHQ and the rest of the Five Eyes are allegedly developing offensive Internet-based capabilities to attack computer networks managing the critical infrastructure of its adversaries.

QWERTY is a module that logs keystrokes from compromised Windows machines; Der Spiegel said the malware is likely several years old and has likely already been replaced.

Kaspersky researchers Raiu and Soumenkov said QWERTY malware is identical in functionality to a particular Regin plugin.

Raiu and Soumenkov said within QWERTY there were three binaries and configuration files. One binary called 20123.sys is a kernel mode component of the QWERTY keylogger that was built from source code also found in a Regin module, a plug-in called 50251.

Side-by-side comparisons of the respective source code shows they are close to identical and sharing large chunks of code.

Regin was discovered in late November by Kaspersky Lab and it was quickly labelled one of the most advanced espionage malware platforms ever studied, surpassing even Stuxnet and Flame in complexity. The platform is used to steal secrets from government agencies, research institutions, banks and can even be tweaked to attack GSM telecom network operators.

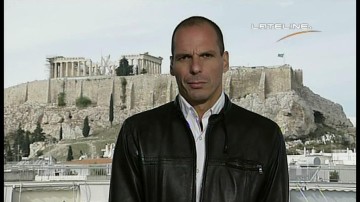

Computer game outfit Valve’s economist Yanis Varoufakis is to be Greece’s new finance minister and tasked with the chore of sorting out the country’s stuffed up economy.

Computer game outfit Valve’s economist Yanis Varoufakis is to be Greece’s new finance minister and tasked with the chore of sorting out the country’s stuffed up economy.

Yanis Varoufakis originally had the job of analyse and improving Valve’s Steam Market but now has been appointed the new finance minister of Greece.

Obviously, Greece’s Euro debt crisis has been critical to Europe over the last few years as the country tried to save up a bit of cash to pay off its crippling debts. The new Greek government dominated by political party Syriza has pledged to stop starving the country to pay off Germans and the armed forces and start spending again.

The Greek economy was crippled by a high public sector wage and pension commitments and Varoufakis has been chosen to sort out the whole mess – preferably without a famous Greek strike.

While working at Valve, Varoufakis often cited nobel-prize winner Friedrich Hayek and classical liberal and Scottish philosopher and economist Adam Smith, when talking about the fundamentals of capitalism introduced in areas hitherto untouched. “Firms can be seen as oases of planning and command within the vast expanse of the market,” he previously wrote.

No one can say that his new job is not challenging, particularly when your history is making sure that a computer games company does well and your main enemy is a bunch of fascists called the Golden Dawn.

The Tame Apple Press is beside itself with joy as it reported that its favourite company had some rather good results.

The Tame Apple Press is beside itself with joy as it reported that its favourite company had some rather good results.

Phrases like “smashed Wall Street expectations.” “record sales” and “largest profit in corporate history” were liberally used.

The company sold 74.5 million iPhones in its fiscal first quarter ended December 27, while many analysts had expected fewer than 70 million. Revenues rose to $74.6 billion from $57.6 billion a year earlier.

S&P analyst Howard Silverblatt claimed that Apple’s $18 billion profit was the biggest ever reported by a public company, worldwide and Apple’s cash pile is now $178 billion, enough to buy IBM.

The Tame Apple Press were even more excited when Apple Chief Executive Officer Tim Cook said the Cupertino, California-based company would release the Apple Watch, in April, nearly two years behind the market.

The press rushed to find analysts who said that Apple was jolly brilliant while Microsoft and IBM had disappointing results.

However, as you might expect there was an element of selective reporting. For example, analysts expected Apple to sell more iPhones in China than the US – it did not. Although sales in China were “up 70 percent on last year” sales behind the bamboo curtain were not that great last year. The Tame Apple Press praised the company’s partnership with China Mobile for being responsible for the increase in sales, ignoring the fact they predicted earlier that China sales would be blistering.

Unable to blame Apple, Reuters blamed the Chinese economic slow down for the poor Chinese outing and instead claimed that Apple was well positioned to do better next year.

Apple reported net profit of $18.02 billion compared with $13.07 billion a year earlier. Analysts had expected revenue of $67.69 billion.

Cooler heads pointed out that Apple would face problems next year because of the stronger dollar and predicted that things would not be as good. Apple predicted revenue of $52 billion to $55 billion in its fiscal second quarter, compared with Wall Street’s average target of $53.79 billion.

Meanwhile Cook was touting new shiny things to encourage more positive talk about the outfit. Not only did he promise to release the iWatch which is now so out of date the specs were originally designed on the great pyramid, he talked about Apple’s new mobile payment service, Apple Pay which is, so far, to make much headway.

The largest profit in corporate history was Fannie Mae which made $84 billion in 2013.

Yahoo plans to spin off its 15 percent stake in China’s Alibaba as shareholders demand that it hand over to shareholders the cash it has made from its prized e-commerce investment.

Yahoo plans to spin off its 15 percent stake in China’s Alibaba as shareholders demand that it hand over to shareholders the cash it has made from its prized e-commerce investment.

The Alibaba shares are worth valued at roughly $40 billion.

Shares of Yahoo rose about seven percent to $51.45 in after hours trading on Tuesday, following the tax-free spinoff announcement and earnings which just beat analysts forecasts even as its revenues slightly lagged estimates.

Selling the Alibaba stake could pressure on Yahoo Chief Executive Marissa Mayer to make quicker progress in strengthening Yahoo’s struggling media and advertising business.

Shareholders feel that Yahoo and its stake in Alibaba would be worth more separately, as long as the Alibaba shares are not subject to the standard 35 percent tax rate that would be incurred from selling the shares.

Yahoo is worth about $45 billion which includes its Alibaba stake of nearly $40 billion, meaning the current Yahoo share price assigns little value to the core business. Some investors believe the email, website and other operations are worth between $7 billion and $8 billion.

Mayer promised investors that the company’s display advertising revenue, which declined 4 percent in 2014, would return to growth this year. But the company’s forecast for revenue in the first quarter implied continuing problems.

Yahoo said that revenue, excluding fees paid to partner websites in the first quarter, would range from $1.02 billion to $1.06 billion, compared to the $1.09 billion last year.

Yahoo said its board of directors has authorized a plan to spin off the stake, tax-free, into a newly formed independent registered investment company. The stock of the company will be distributed pro-rata to Yahoo shareholders and the transaction is expected to close in the fourth quarter of 2015, Yahoo said.

The new entity will include Yahoo’s 384 million shares in Alibaba as well as an unspecified “legacy, ancillary” Yahoo business, the company said.

Yahoo’s revenue, excluding fees paid to partner websites, declined 1.8 percent year-on-year in the final three months of 2014 to $1.18 billion, just shy of Wall Street expectations.

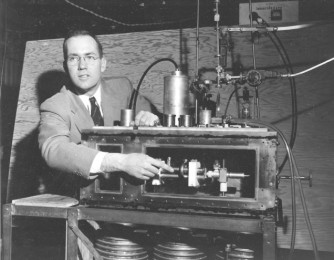

The boffin who laid the foundations for the development of the laser has died. Charles Townes was 99.

The boffin who laid the foundations for the development of the laser has died. Charles Townes was 99.

Townes who won the Nobel Prize for Physics in 1964 is best known as the “inventor” of the laser but he was also a pioneer in the field of infrared astronomy and was the first to discover water in space.

He first built a maser in the mid-1950s, which used microwave amplification rather than light.

At the time Gordon Gould at ARPA and Ted Maiman at Hughes Labs were working on similar research in the late 1950s. I Maiman who built a practical laser in 1960, but he used the published research of Townes.

Townes shared his 1964 Nobel Prize with Russian scientists N. G. Basov and Aleksandr Prokhorov because they were also working on the laser in the Soviet Union concurrently and independently of Townes.

Later in his life, he became famous for suggesting that one-day science and religion would one day merge, revealing the secrets of creation.

The committed Christian told some Harvard students: “I look at science and religion as quite parallel, much more similar than most people think and that in the long run, they must converge. It’s a fantastically specialized universe, but how in the world did it happen?”

He was honoured in 2005 with the Templeton Prize for contributions to “affirming life’s spiritual dimension.”

Townes never really stopped working and would show up at Berkeley until he became unwell last year.

He did live long enough for his laser to be turned into the sci-fi weapon that it was touted to be in the 1960s, although not long enough to see them strapped to sharks.

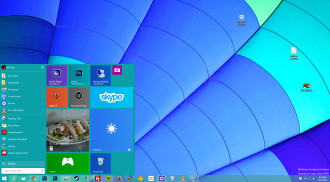

Microsoft appears to have further muddied the waters with its announcements about Windows 10 last week.

Microsoft appears to have further muddied the waters with its announcements about Windows 10 last week.

Lithium ion batteries are notorious for overheating because of short circuits – whether they’re in notebooks, in phones or in Boeing 787 Dreamliners.

Lithium ion batteries are notorious for overheating because of short circuits – whether they’re in notebooks, in phones or in Boeing 787 Dreamliners.