Intel is working out a way of using Moore’s law beyond the 10 nanometre (nm) node.

Intel is working out a way of using Moore’s law beyond the 10 nanometre (nm) node.

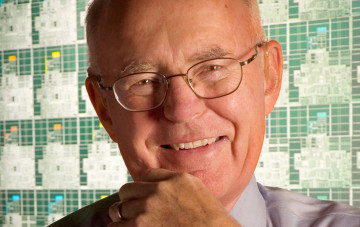

Mark Bohr, senior fellow for logic technology development at Intel, told hacks he will take part in a panel discussion on the move beyond 10nm and the many challenges it poses soon.

Per the existing roadmap, the company expects to move to 10nm in 2016 and to 7nm in 2018.

“I still believe we can do 7nm without EUV [Extreme Ultraviolet Lithography] and deliver improved cost per transistor. I’m not going to say exactly how, because our competitors watch what we do closely,” Bohr said.

Intel has published papers on III-V [three-five] devices and that is one of the new materials that CHipzilla is looking at to move to 7nm. As always Intel is worried about balancing performance against manufacturability .

However all this flags the fact that EUV, for long considered the best bet to replace current 193-nm lithography and extend Moore’s law beyond 10nm, isn’t ready. In fact it has been half-backed for nearly a decade.

“Scaling does continue to provide lower cost per transistor, and it is Intel’s view that cost reduction is needed to justify new generations of process technology,” he said.

“Going forward, heterogeneous integration will become increasingly important, but we may not be able to do it all on one chip, so you will see more use of SoC solutions such as 2.5D integration, where two are mounted side by side on a substrate, or full 3D integration, stacking chips on top of each other, each one tuned for a different [manufacturing] process to perform different functions, Bohr said.