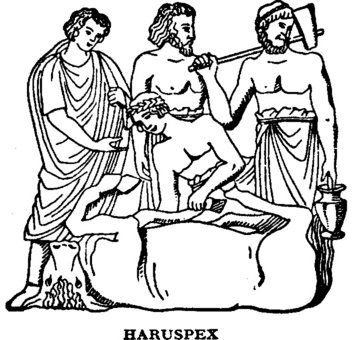

The fortune-tellers at RBC Capital Markets have emerged from their blood-stained temples with a dark prediction for MediaTek.

The fortune-tellers at RBC Capital Markets have emerged from their blood-stained temples with a dark prediction for MediaTek.

Analyst Doug Freedman, after seeing the liver of a particularly well fed Ram, claims that Intel will write a cheque for $27 billion to buy wireless chipmaker MediaTek within three years.

He told the Street that the deal would make sense as Intel’s earnings would grow and would help stop the investment losses it is incurring to grow wireless market share.

Freedman said the deal will happen within the next two-to-three years “almost out of necessity.” He said that MediaTek’s purchase is Intel’s best option to grow in the wireless market. Intel may also find that the timing is improving for a large deal as the baseband market continues to consolidate, the analyst said.

Although $27 billion is a lot of dosh, Chipzilla is already spending more than $1 billion a quarter to expand into the mobile and wireless market. This money appears to be just disappearing and the company is suffering heavy losses in the unit as it tries to boost market share beyond the single digits. Over all buying MediaTek could be a less expensive way to drive market share gains and would entail less risk, Freedman said.

MediaTek is a big name in mobile and tablet chipsets, in addition to Bluetooth, WLAN and GPS chips and NFC system on chips. While Intel pines away in the baseband market, MediaTek has made steady market share gains.

This would be the second time that Intel has had to buy the stairway to wireless heaven. In 2010 Intel bought Infineon’s wireless solutions business for $1.4 billion . However Intel’s baseband market share has fallen to the mid-single digits.

Intel has made significant investments but it isn’t expected to post revenue growth in the next two and a half years, according to Wall Street consensus.