European purchases of 3D printers, materials, software, and related services are expected to total $3.6 billion in 2017, according to beancounters at IDC.

European purchases of 3D printers, materials, software, and related services are expected to total $3.6 billion in 2017, according to beancounters at IDC.

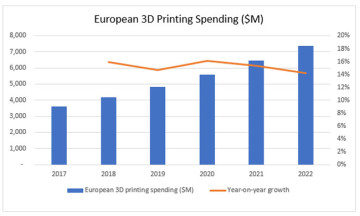

According to the latest update to the Worldwide Semiannual 3D Printing Spending Guide from International Data Corporation (IDC), the combined spending on 3D printing for Western Europe and Central and Eastern Europe will experience a five-year compound annual growth rate of 15.3 percent, with revenues reaching $7.4 billion in 2022.

Western Europe delivered 83 per cent of total European 3D printing revenues in 2017 and will remain by far the largest contributor in the wider European region, growing at a CAGR of 14.4 percent for 2017–2022. Central and Eastern Europe will be the fastest-growing region, however, with a CAGR of 19.1 percent for 2017–2022.

IDC research manager, European Imaging, Printing and Document Solutions Julio Vial said the 3D printing market is evolving rapidly, with the European market continuing to show good momentum and 2018 proving to be a turning point.

“3D printing has the potential to expand the manufacturing industry, shift distribution locally, and implement on-demand production, reducing unnecessary inventories and shipping costs. It will enable mass customization and printing of different products while reducing costs and recycling excess printer powder. Product weight can also be reduced, and fewer tools will be needed because 3D printers can replace some of them”, Vail said.

Though 3D printing hardware generated the largest spending in 2017, the focus on materials will drive associated spending in the coming years, with a CAGR of 20 per cent in the forecast period, exceeding the hardware component. Services will remain a key part of the market, as consulting and system integration services are a critical component of the 3D printing solution deployment.