A series of optimistic reports and forecasts on e-commerce seems to indicate that mobile payments are becoming increasingly commonplace and that we could soon ditch our trusty leather wallets in favour of smartphones. Sadly though, we won’t, at least not anytime soon.

A series of optimistic reports and forecasts on e-commerce seems to indicate that mobile payments are becoming increasingly commonplace and that we could soon ditch our trusty leather wallets in favour of smartphones. Sadly though, we won’t, at least not anytime soon.

The trend is positive and we are seeing a lot of growth, especially in m-commerce. In addition, a number of big players have made significant announcements in recent months. Last week Visa expanded its Visa Ready Partner Programme in an effort to get more vendors, developers and retailers on board. Samsung followed up with a service of its own, the Samsung Wallet, which bears more than a passing resemblance to Apple’s Passbook app. Samsung already managed to attract several partners for its new service, including Visa.

Then there is MasterCard’s MasterPass service, which allows retailers come up with their own applications and services, based on MasterCard’s infrastructure. PayPal is no newcomer to the market, but its PayPal Here service is. Launched in the US last year, it finally found its way across the pond to European shores. It offers a comprehensive solution, with a hardware dongle and cross-platform app support, and it allows users to pay using credit cards, cash, PayPall wallet or checks.

What about the elephant in the room? Well, there’s actually two elephants. Google Wallet has been around for quite a while, but it failed to take off. It was supposed to demonstrate NFC capabilities on Nexus gear, dating back to the Nexus S, which it did. However, much like NFC, Google Wallet never made much of a name for itself.

It might have something to do with the second elephant, Apple, as it never embraced NFC technology and it is still unclear whether the next iPhone will feature it. Apple has not made much noise on the mobile payment front, which doesn’t mean it is not looking into it. To the contrary, Apple has already filed several patents for NFC enabled devices and services. Cupertino doesn’t like spilling the beans on upcoming products and services, and unlike some companies, it tends to have excellent execution. It is also worth noting that Apple bought AuthenTec, a maker of fingerprint sensors and security solutions, for $356 million last year.

With all that in mind, nobody should be surprised by soaring m-commerce and mobile payments statistics. In fact, we should be seeing even more services, from brick and mortar shops to pubs, but we aren’t. Mobile payments and are still geeky turf, with little traction among mainstream consumers. The sheer lack of widespread support for m-commerce platforms and the fast pace of development means that many consumers don’t even know it exists. What’s more, many of those that do still have some reservations.

Privacy and security are valid concerns, but a recent survey by Intela revealed that the majority of smartphone users in the UK now feel comfortable with mobile payments. It is hardly surprising, as most smartphone users have grown accustomed to making micro transactions in app stores or through in-app payments. The difference between spending a few pence on an app and a few pounds in a retail shop is philosophical and not technical in nature. In fact, it appears that humble micro transactions have already done more for m-commerce confidence than all the fancy services rolled out by credit card companies and tech outfits.

In spite of that, smartphones will not replace wallets, at least not entirely and certainly not anytime soon. Cash can’t be hacked, it can’t be rendered useless by a flat battery or a few drops of lager. In some cases it is just more practical. The same pretty much goes for credit cards. Smartphones have their own set of advantages. Motorway tolls, public transportation, congestion charges and parking based on GPS information are some that come to mind. Phones are an excellent payment platform, but they will complement cash and cards, not replace them.

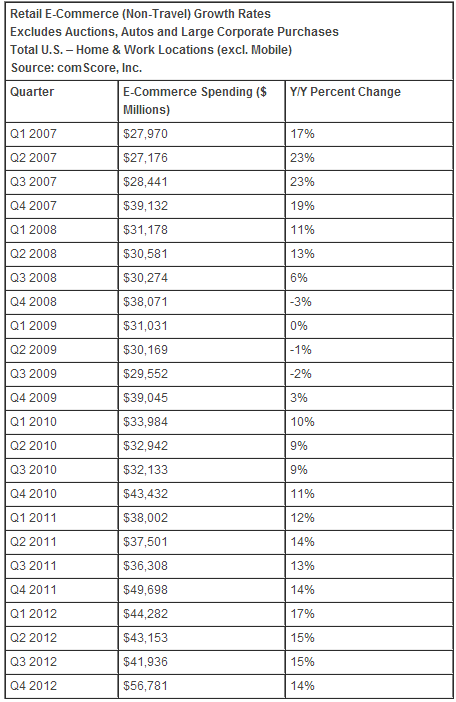

Although British retailers seem to have an upper hand in European mobile commerce, a new report indicates that they are lagging behind their American counterparts in m-commerce.

Although British retailers seem to have an upper hand in European mobile commerce, a new report indicates that they are lagging behind their American counterparts in m-commerce.