Intel released its fourth quarter 2014 results yesterday afternoon with income jumping 39 percent on improved demand for personal computer and server system chips. The company allowed that it is expecting a somewhat flat first quarter for 2015 which led shares 1.9% lower in after-hours trading. The PC Client Group’s earnings improved by three percent while the Data Centre Group’s earnings improved by 25 percent. Overall revenue increased by six percent year-on-year and gross profit margin exceeded 65 percent.

Analysts polled by Thomson Reuters expected per-share earnings of 66 cents and revenue of $14.71 billion.

For the current first quarter, Intel projected revenue between $13.2 billion and $14.2 billion and gross margin of 60 percent, plus or minus a couple percentage points. Analysts, on average, were expecting revenue of $13.76 billion and gross margin of 61.2 percent, according to Reuters.

For the year, Intel projected revenue to rise by a mid-single digits percentage rate and achieve a gross margin of 62% of revenue, plus or minus a couple percentage points. Analysts, on average, were expecting revenue to rise 4% and gross margin of 63.4%, according to Reuters.

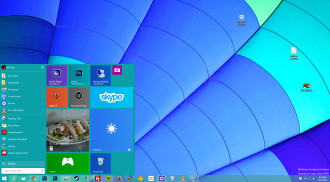

PC Client Group Improves

Intel’s integral attachment to the PC market greatly affected earnings as the PC market growth slowed and consumer market demand was satisfied with less costly tablets and high capacity smartphones. The uptick in PC demand last spring has had a positive effect on earnings and aided in the company’s turnaround effort to become “the” dominant supplier in the mobile market. With Intel’s 14 nm manufacturing muscle Brian Krzanich is now “loaded for ARM” vowing to place 40 million Intel chips into tablets now dominated by ARM Holdings PLC.

3D 256 Gb NAND-Flash Bundling?

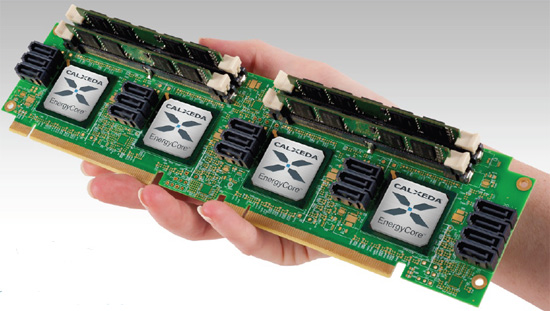

No mention was made by Intel of its recently announced 3D 256 Gb NAND-Flash devices. Intel has what can only be called an obsession with its ability to control the memory side of the sales equation without owning any of the fixed assets to produce it.

Analysts have been wondering why Micron was not more upbeat on the announcement; it is, after all the controlling partner in Intel-Micron Flash Technologies, Inc. (IMFT). Sources indicate that Intel will most likely begin bundling Processors and Memory kits with Intel claiming the lion’s share of margin leaving Micron to its own pursuits with its share of output.

Last but Not Least

The Data Centre Group is rumoured to be the earnings darling of the coming quarters with sources indicating market moving announcements over the first half of 2015. Those announcements concern Intel’s SDN for Cloud Computing efforts…

British chip designer ARM has bought Dutch firm Offspark, which is an open source security software outfit.

British chip designer ARM has bought Dutch firm Offspark, which is an open source security software outfit.