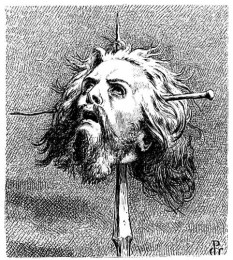

Knives are being sharpened, torches and pitchforks are being prepared, as Yahoo shareholders prepare to lynch CEO Marissa Mayer.

Knives are being sharpened, torches and pitchforks are being prepared, as Yahoo shareholders prepare to lynch CEO Marissa Mayer.

So far the top 10 Yahoo shareholders have made a direct appeal to AOL CEO Tim Armstrong to explore a merger and run the combined company.

Their move follows an activist campaign by hedge fund Starboard Value, which is pushing Yahoo to consider a deal with AOL and unlock Yahoo’s valuable stakes in Asian Web companies.

Armstrong has been receptive to these Yahoo shareholders and acknowledged the potential benefits of a deal, the Yahoo investors said.

But Armstrong has indicated he would only consider a friendly deal, which would probably not involve Mayer’s head on display.

Shareholders think that if the two companies merged the combined company could yield as much as $1.5 billion in cost savings.

Starboard wants Yahoo to spin off its Web and email business, merging them into AOL, one Yahoo investor who has spoken with the activist said. That would leave Yahoo’s holdings in Chinese e-commerce giant Alibaba and Yahoo Japan in a separate company, satisfying investors who want the company to monetize those assets.

Starboard has a history of taking on AOL, unsuccessfully. In 2012 it lost a battle to unseat three board directors.

Armstrong is a former Google exec who has been at the helm at AOL since 2009, is credited with reviving a dying brand. AOLs market cap of $3.5 billion has roughly doubled in value since he has been in charge.

Yahoo stock has tripled since Mayer joined Yahoo as CEO in July 2012, but most of this is due to the rapid appreciation in the value of its Asian assets. Mayer has urged investors to be patient for what she has said will be a multi-year effort to revitalise the company.