US banks have finally twigged that the reason they keep losing money to credit card theft is because they insist on being the last bastion of low tech cards.

US banks have finally twigged that the reason they keep losing money to credit card theft is because they insist on being the last bastion of low tech cards.

Given the fact that the free market is supposed to decide the best form of technology to defend its transactions, the US banks have been dragging their collective trotters adopting the EMV standard.

Meanwhile in Europe, the birthplace of Europay, MasterCard and Visa (EMV) standard there is a low amount of credit card fraud while in the US it is incredibly high.

Now the US is finally making the transition to secure cards based on the European EMV standard, mostly because the liability shift imposed by the three big credit card brands — Visa, MasterCard and American Express — will start on October.

If the merchant is EMV compliant and has a POS system equipped to read EMV cards, and the card is not, because the financial institution has not started issuing them yet — effectively forcing the merchant to run your card on the magnetic stripe reader — then the bank or credit card issuer has to pay for the misuse of the card.

If the issuer has upgraded to EMV by sending chip cards to its cardholders, but the merchant has not upgraded their point of sale to accept them, the retailer bears the cost for counterfeit fraud.

While all this is a pain for the banks and retailers, it is widely accepted in the US that something has to be done. A wave of data breaches that has hit major retailers such as Target and Home Depot, among others, has convinced many card issuers that the expense of sending new cards fades in comparison to the consequences of new data breaches. It will probably take another three years for full adoption.

Some analysts expect fraud to increase this year, as thieves will step up their efforts to capture more credit card details before the EMV conversion starts to take a grip on their bottom line.

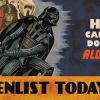

It is unclear why the US has been so slow in adopting the chips, one reason might be the fact that their parts of the US which may refuse to use them because of religious reasons. Parts of the bible belt believe that the move to such technology is a sign of the “end times” and that any electronic transactions are the same as the “mark of the beast” of revelation.