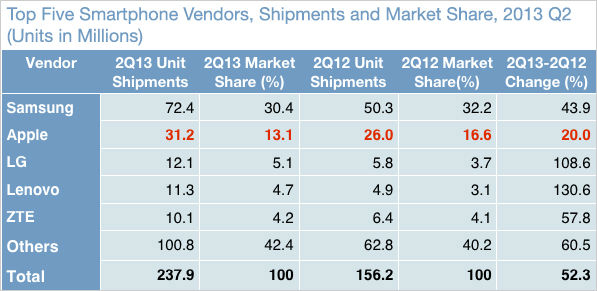

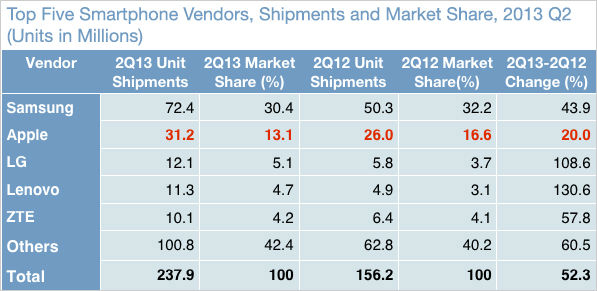

Apple’s iPhone juggernaut appears to be running out of steam. Although the company beat Wall Street expectations last quarter, with 31.2 million iPhones shipped, it also managed to lose market share.

Apple’s iPhone juggernaut appears to be running out of steam. Although the company beat Wall Street expectations last quarter, with 31.2 million iPhones shipped, it also managed to lose market share.

Apple’s smartphone share now stands at 13.1 percent, down from 16.6 percent in the second quarter of 2012. Although Apple’s shipments were up from 26 million a year ago, the market grew at a somewhat faster pace. The same goes for Samsung, which shipped 72.4 million smartphones last quarter, up from 50.3 million last year. It share dropped from 32.2 percent to 30.4 percent.

Total smartphone shipments were up 52 percent, 237.9 million compared to 156.2 million units in Q2 2012. The market seems to be accelerating, maybe even overheating. However, although smartphone saturation in western markets is becoming an issue, particularly in the high-end, Asia appears to be doing quite well.

Chinese smartphone churners had a very good quarter. Lenovo upped its market share from 3.1 percent a year ago to 4.7 percent last quarter. Lenovo shipped 11.3 million smartphones last quarter, roughly a third of what Apple managed to ship – but most Lenovo phones were sold in China, hence the tech press didn’t really cover its success. ZTE also did well, with shipments hitting 10.1 million last quarter, up from 6.4 million a year ago. LG did surprisingly well, with 12.1 million units shipped, up from just 5.8 million a year ago.

However, saturation is becoming a big source of concern for smartphone makers. Most future growth is expected to come from emerging markets, which tend to prefer low cost devices. This will result in lower ASPs, more competition and lower margins. It will also open the room for smaller brands and dozens of Chinese no-name smartphone makers.

IDC’s figures also reveal that the combined share commanded by smaller brands is up and that smartphone shipments have finally outpaced feature phone shipments. Few consumers who haven’t transitioned to smartphones over the last few years will pick up a high-end device, leaving even more room for cheap smartphones.

The trend has not gone unnoticed by smartphone makers. Apple is reportedly working on a cheaper, plastic version of the iPhone. Since Apple doesn’t have much to offer outside the high-end market, it is particularly vulnerable. Samsung and HTC are talking up their new minis as if they were flagship products, Google Motorola’s new Moto X is a mid-range device, not a pricey superphone.

In recent years the focus was on pricey high-end phones, with most sales coming from affluent markets, backed by carrier sweetheart deals. This created a rather absurd situation, as unit sales of high-end phones were often much higher than those of their mid-range and low-end siblings. As emerging markets enter the fray, this odd trend appears to be over.

Chinese telecomms provider ZTE said higher sales of 4G network kit and smartphones meant that for its financial year it turned in a 94 percent net profit increased.

Chinese telecomms provider ZTE said higher sales of 4G network kit and smartphones meant that for its financial year it turned in a 94 percent net profit increased.