Although British retailers seem to have an upper hand in European mobile commerce, a new report indicates that they are lagging behind their American counterparts in m-commerce.

Although British retailers seem to have an upper hand in European mobile commerce, a new report indicates that they are lagging behind their American counterparts in m-commerce.

The study was carried out by multi-touch retail technology provided Skava, and it found that only half of Britain’s top 100 retailers have optimized their websites for mobile devices. In contrast, all of the top US retailers have already done so.

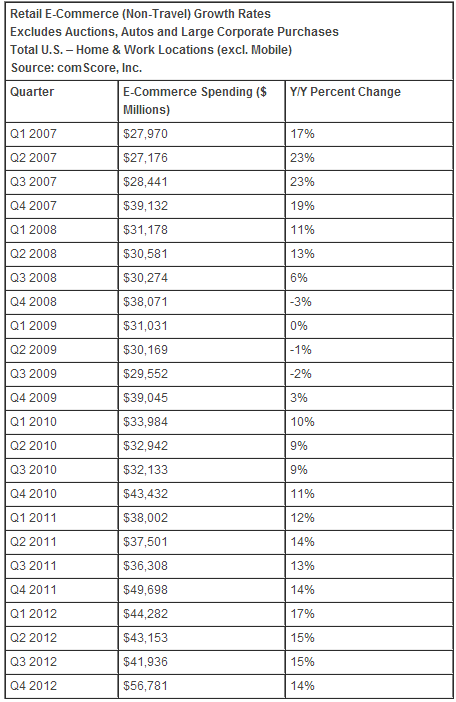

The study found that revenue from mobile accounts for about one percent of all online sales in Europe. However, it is growing at a compound rate of 43.1 percent. Forrester estimated mobile revenue will account for 6.8 percent of European online revenue by 2017. That amounts to 19 billion euro.

Forrester analyst Martin Gill stressed that UK retailers have to adopt mobile tech if they hope to move forward. However, he also believes they will face plenty of challenges.

“A number of factors encourage and inhibit the adoption of mobile commerce… consumer trust, the convenience and value proposition of mobile shopping, the ease of payment and the availability of products at the right price,” said Gill. “European eBusiness executives in many countries have been slow to provide mobile-optimized experiences and these factors — both supply and demand — will continue to limit the opportunities.”

The study found that smartphone and tablet users tend to interact with their devices quite a bit differently than PC users. Hence, retailers’ websites must be optimized to cater to new platforms. They also need to respond quickly to new market trends and devices, which is easier said than done due to the mind boggling pace of progress in the mobile industry.