The writing was on the wall for Intel-based Ultrabooks well over a year ago.

The writing was on the wall for Intel-based Ultrabooks well over a year ago.

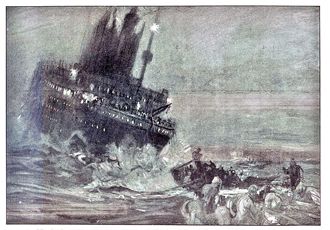

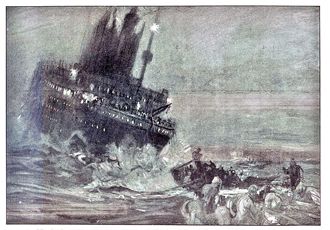

Overpriced, underwhelming, and facing massive competition from tablets and smartphones and trends such as bring your own device (BYOD), few families would take the risk of spending over $1,000 to have a bright shiny Ultrabook and keeping an eye on jobs and the general economic situation, large corporations weren’t going to splash the cash either.

So the news that Ultrabooks are set to cost far less for the holiday season this year is probably a case of too little too late. It also begs a number of questions about Intel’s business model which remain to be resolved.

Intel’s phenomenal growth was due, in a large part, to the monopolistic hold it had on the PC industry. True, AMD was around to mitigate that, but it was only in the days of the AMD Opteron that Intel was forced to react. Because it holds such a large X86 market share, that meant that the revenues from sales of its microprocessors allowed it to finance developing the next generation of its CPUs. Building fabs is not a trivial matter and involves billions of dollars of investment. Intel could afford to do this because during its so-called “tick tock” cycle, it was able to maximise profits on its current generation of semiconductors, while developing its next generation.

However, this continual growth could never be guaranteed, and disruptive technology, in the shape of tablets and smartphones, meant that given a choice, lots of people preferred to pay far less for tablets and smartphones rather than go for Ultrabooks at $1,000 plus.

And with this we come to applications and the realm of the other great X86 monopolist, Microsoft. It’s certainly true that typing on a smartphone or a tablet is not nearly as convenient as using a conventional keyboard. And if you are into solid beancounting, you’ll certainly need a sophisticated spreadsheet to manipulate the numbers. Despite the now decades long promise of the paperless office, people still print stuff. Microsoft, with Windows 8 and its tablet ready interface is too expensive. It, like Intel, has lost its grip on the electronics market.

There’s another factor to consider, too. Right now, Intel is in an interregnum period. Paul Otellini, the current CEO, is due to leave at the end of May. Intel is actively recruiting for another CEO, but that means, in the short term, that no-one is going to make huge company wide decisions.

In truth, it’s hard for me, as a seasoned Intel watcher, to see quite what rabbit the new Intel CEO, whoever she or he might be, might pull out of the corporate top hat. Intel has been in fixes before, and because of its size and its sway can never be underestimated. But it’s hard to see it making very much more than a ripple in the smartphone and tablet market, leaving it between a ROC and a hard place. It’s also hard to see where the complex supply chain it generates is going to end up, too.

Average selling prices (ASPs) of Intel based ultrabooks and tablets fell by close to eight percent this year in all markets worldwide.

Average selling prices (ASPs) of Intel based ultrabooks and tablets fell by close to eight percent this year in all markets worldwide.