Last week, TechEye visited IEF 2013 in Dublin to hear what the semiconductor industry had to say for itself. Here’s the roundup:

Last week, TechEye visited IEF 2013 in Dublin to hear what the semiconductor industry had to say for itself. Here’s the roundup:

Imagination Technologies’ Tony King-Smith said the future really relies not on the humble CPU but industry and engine cooperation for the System on Chip. “SoCs means everything is now mobile, and continues to have advanced capabilities. They are the only way to get scaleability,” King-Smith said.

Barry O’Leary, CEO of IDA Ireland, talked about investment in the Emerald Isle. Naturally the 12 percent corporation tax was mentioned. Four of the most crucial investors in Ireland are in tech, including Intel and HP, and social media is also experiencing huge growth. The IDA chiefly looks at manufacturing and R&D.

Senior Nvidia research scientist John Chen told the audience about various problems associated with nodes at under 20nm, specifically in performance, perfection and precision. But technologies like zero leakage transistors, III-V, Ge channel and carbon nanotubes will help the industry march on.

EU commissioner for digital agenda, Neelie Kroes, gave a keynote about Europe’s hopes to punch up in technology and innovation, including spending of €100 billion in R&D by 2020, leading to job creation, we were told, as well as smarter kit. Europe also wants to boost its performance in production capabilities.

TSMC’s senior director of R&D, Yee-Chaung See, highlighted problems in EUV and talked up the company’s 20 nano SoCs, adding qualification for 16 nano SoCs should be finished by the end of the year. It’s focusing on 3D stacking, while there are already high yields in SRAM. Gains in 3D, it is hoped, will lead to producing a silicon system super chip, that can integrate analogue, image sensors, photonics, MEMS and TSV.

Ram Ramamoorthy, professor at Edinburgh University, unfortunately indicated it’ll be a long time, if ever, if replicants of iconic futuristic dystopia Bladerunner are going to come to be. A machine is where the sophistication is such a robot can simulate some human senses like sight and sound. That means football playing robots, but they’re not great at it yet.

“The level of intelligence of robots in movies is very difficult to achieve,” Ramamoorthy said. “It’s very hard to deal with real people but in reality it’s very hard to model human users, that’s one of the biggest challenges we’re looking at”.

Plessey CEO Michael Le Goff told the room that, by using Gallium Nitride on silicon substrates to create LEDs, advanced lighting will be lower cost. And eventually, you’ll die before your lightbulb does.

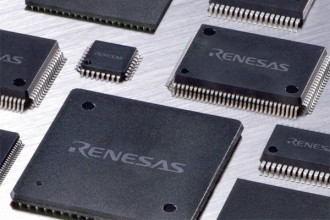

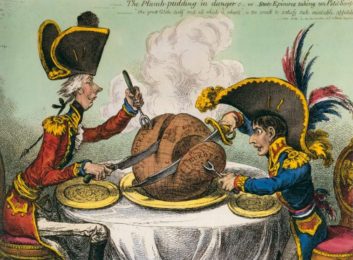

Principle analyst at Future Horizons, which hosted the conference, Malcolm Penn, warned that there is a “chip crunch” around the corner. “The basics of fab capacity is cast in stone,” Penn said. “Capacity can’t be influenced for a year. We’ve not being building capacity which I think is dangerous,” Penn said. “There’s a silicon crunch just around the next corner. The most crucial part of the food chain is being treated with complete cavalier indifference. That’s because the capital spend is too low”.

Microsoft Cambridge’s senior research director, Alex Butler, talked the room through various research projects at the company. That includes advances in touch, and Butler assures us that although many of the R&D group’s creations won’t see the light of day, others find their way into products. The group is interested in the future of tech, five, 10 or 15 years away from now.

Compound semiconductors will play a major role in a different kind of Moore’s Law, Drew Nelson, CEO of IQE, asserted. Although silicon is approaching its natural limits, compound semiconductors have more functionality and flexibility – according to Nelson, the materials are just better that silicon, and from a power perspective there is a clear lead.

Crocus doesn’t have MRAM in the market yet, but there’s a licence agreement with IBM for 65/45nm memory logic units to go into production later this year, CEO Jacques Noels said. Crocus thinks it has figured out stability problems in magnetic memories, while 28nm for generation 4 is on the horizon.

Investment company Convergence’s CEO and former Director General of the Department of Communications in South Africa, Andile Ngcaba, spoke on trends across the African continent. Just in 1990, there were more phones in Manhattan than the entire continent, but with the emergence of mobile there is more connectivity than ever. However, getting connected proves challenging: poly silicon is expensive and not particularly economical at the moment. So petrochemical companies are cleaning up with fossil fuel-powered base stations.

*EyeSee We’ve heard that some chip giants are being economical with the truth about the size of their semiconductors. TSMC’s 14nm chips are a little closer to 20nm. Intel’s 14nm chips are between 16nm to 17nm, and Samsung’s measure in at roughly 18nm. None were available for comment.

Yesterday’s news that Nvidia and Intel are snuggling up for a glorious alliance could cause some major headaches for the industry.

Yesterday’s news that Nvidia and Intel are snuggling up for a glorious alliance could cause some major headaches for the industry. Kicking Pat Gelsinger, Intel’s CEO, has ruled out the notion that the company will build semiconductor facilities in the UK because it’s not part of the European Union anymore.

Kicking Pat Gelsinger, Intel’s CEO, has ruled out the notion that the company will build semiconductor facilities in the UK because it’s not part of the European Union anymore.