Financial technology company SunGard Data Systems is planning to sell itself off for $10 billion, including its pile of debt.

Financial technology company SunGard Data Systems is planning to sell itself off for $10 billion, including its pile of debt.

SunGard has popped around to the investment banks collecting advisory mandates to prepare for interviews as early as next week, the people said. The company is thinking about either an outright sale as well as a potential initial public offering.

SunGard is owned by private equity companies and apparently decided to explore a sale after it was approached by at least one other company about a potential takeover.

So far it is all rumour and speculation. But the company is a bit of an oddity. It was bought up by the finance companies just before the 2008 financial crisis. Normally they are gutted off their assets like a kipper and what is left is flogged off.

However the equity companies hung on to SunGard making it one of the longest-held investments in private equity history. Part of the problem is that its owners have struggled to boost the company’s value to the point where they can cash out and make a decent return.

This is odd really as you would think that Silver Lake Partners, TPG Capital, Bain Capital, Blackstone Group, Goldman Sachs Capital, KKR and Providence Equity Partners could not make a fist of making the company a success no-one could.

What appears to have happened is that since the buyout, the firms have leached money from SunGard. In 2012 they paid themselves $720 million with their first dividend from the company.

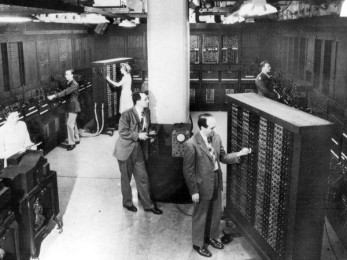

SunGard provides software and processing services for financial firms and also serves the education and public sectors. Last year, it spun off its disaster recovery unit, which represented about a third of its revenue.

It makes $2.8 billion in annual revenue but it has a $4.7 billion and a cash pile of $447 million..

Redcentric has completed its acquisition of assets from Sungard Availability Services.

Redcentric has completed its acquisition of assets from Sungard Availability Services.