Barracuda Networks has warned that EMEA business is boosting investment in cloud-friendly networking technologies, despite a lack of education and skill.

Barracuda Networks has warned that EMEA business is boosting investment in cloud-friendly networking technologies, despite a lack of education and skill.

VP and general manager, network security, Dr Klaus Gheri’s comments are based on the findings of a study of 410 IT and networking professionals released today by Barracuda Networks.

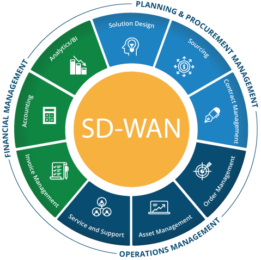

The study found that 89 percent of EMEA organisations were either already using software defined wide area networking (SD-WAN), a technology that helps users access the cloud quickly and securely, or are considering it

The biggest driver for implementing SD-WAN is to improve application performance between locations. The IT C-suite handles the most (28 percent) SD-WAN projects.

Eight out of ten EMEA organisations think that their SD-WAN solution has lived up to expectations.

The study also showed that EMEA lags behind the rest of the world in SD-WAN knowledge: only 32.7 percent fully understand SD-WAN, compared to a global average of 41 percent.

Generally, EMEA thinks SD-WAN has been overhyped, with over half of organisations thinking it is a buzzword and won’t revolutionise networking. This is higher than the US and APAC.

The number one issue for a third of those who have deployed SD-WAN was a lack of internal skill and understanding.

More than 40 percent think SD-WAN will replace MPLS. Almost two-thirds believe there’s currently not enough SD-WAN training in their organisation.

Gheri said that despite its success, SD-WAN education in the EMEA region leaves a lot to be desired.

Less than a third felt that they understood SD-WAN, falling far behind the US (57 percent ) and APAC (41 percent).

“While this may be more to do with hubris than reality, it’s leading to a lack of internal skill and understanding to deploy SD-WAN, which is highlighted by more than a third (34 per cent) of EMEA respondents as the main issue following its deployment,” Gheri said.

This research clearly shows that the new European data regulation has helped organisations in EMEA wake up to the reality of cyber threats, with many taking the plunge into SD-WAN as a result, Gheri said.

“It’s comforting to see that for many organisations, cybersecurity has become not only the number one focus for IT teams, but has also risen to a CEO level issue.”

Beancounters at IDC have added up some numbers and concluded that customers are keen on the much-hyped SD-WAN tech.

Beancounters at IDC have added up some numbers and concluded that customers are keen on the much-hyped SD-WAN tech.