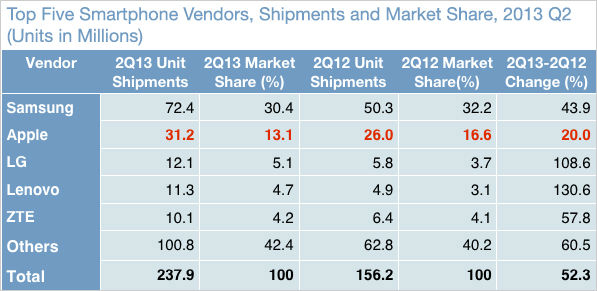

Sales of high-end smartphones are still very strong, but the market seems to be slowly shifting to cheaper gear.

Sales of high-end smartphones are still very strong, but the market seems to be slowly shifting to cheaper gear.

As smartphone penetration rates in developed markets are already relatively high, much of the new growth is coming from emerging markets which don’t have the capacity to gobble up millions of pricey iPhones and flagship Galaxies.

According to IDC, the average price of smartphones has dropped from $450 to $375 since early 2012. As growth is now being generated in China and India, cheaper smartphones are starting to take off. Lenovo stands to gain from the trend, as it already has a very powerful grip on the Chinese market. Chinese players like Huawei and ZTE should also do well. The big losers might be Apple and Samsung, but nobody expects them to sulk and sob in the corner while their lead evaporates.

Apple is apparently working on a cheaper, plastic iPhone, designed specifically to target emerging markets. Samsung and HTC already have mini versions of their flagship phones and although the Galaxy S3 Mini was a disappointment, HTC seems to have cracked it with the HTC One Mini. Motorola’s new X-phone, or Moto X, is set to launch in a week or so and it won’t be a high-end device as many had expected.

However, Chinese smartphone makers still might get the best of big brands. We are seeing similar trends in the low-end tablet market. Chinese manufacturers can respond to changes much faster, they are more dynamic and their costs are much lower. Samsung and Apple might spend hundreds of millions on marketing, but no-name smartphone makers can’t rely on an overpaid hype machine – their only choice is to come up with low-BOM (bill of materials), yet competitive low-margin products, which means China is actually teaching the West a lesson in capitalism.

ABI analyst Michael Morgan told Bloomberg that the days of fast growth in the high-end smartphone market are over.

“It’s the Chinese companies who know how to survive on tiny margins that are ready for the fight that’s about to ensue,” he said.

In other words we may be in for a repeat of the PC price slump of the mid nineties. Chinese manufacturers can churn out cheap smartphones and tablets, much like PCs, but this time around the shift might even be faster. Even if Chinese companies can’t access the latest and greatest in mobile tech, that doesn’t really matter in the mid-range and low-end. Last year’s tech is good enough and it’s cheap, which is exactly what they need.

Furthermore, most chipmakers should have no qualms about selling their latest processors to anyone willing to pay – since most of them don’t have their own smartphone business, although Samsung is an exception. The same goes for most other components and some chipmakers have a vested interest in peddling their own designs. Nvidia seems to be leading the way, as it is already working on reference smartphone and tablet designs. Its next SoC (Tegra 4i) is a mid-range chip with LTE and the first products based on the new chip, and possibly Nvidia’s reference design, should appear in early 2014.

This is also pretty bad news for Nokia, which had hoped to replace its Symbian and S40-based offerings with cheap Windows phones. However, Nokia feature phone users in emerging markets seem to be choosing cheap Chinese Androids instead.

However, most high-end smartphone sales in Europe are still coming from carriers, thanks to comprehensive (and usually quite pricey) two-year plans. If European and US carriers embrace more mid-range Chinese phones, things could change in a heartbeat.

Solid-state drives are the new black and they are slowly starting to trickle down into mainstream PCs, thanks to cheaper Ultrabooks and increasing demand for non-enterprise drives. According to research firm IHS, SSD shipments for ultrathin notebooks and Ultrabooks totalled 5.9 million units this year, up from just 1.9 million a year ago.

Solid-state drives are the new black and they are slowly starting to trickle down into mainstream PCs, thanks to cheaper Ultrabooks and increasing demand for non-enterprise drives. According to research firm IHS, SSD shipments for ultrathin notebooks and Ultrabooks totalled 5.9 million units this year, up from just 1.9 million a year ago.