The commercial sector has been a PC sales hotspot helping the market deliver low growth in third quarter, at least in Western Europe.

The commercial sector has been a PC sales hotspot helping the market deliver low growth in third quarter, at least in Western Europe.

Bean counters from Context have been adding up the numbers, and dividing by their shoe size and decided that the commercial sector has been a growth area. While the back to school windows for the PC market have been disappointing, commercial orders grew to cover up the problems as efficiently as woodchip wallpaper.

Context said that most of the third quarter was used by distribution to clear PC inventory, using special promotions as a tool, to get things ready for the fourth quarter.

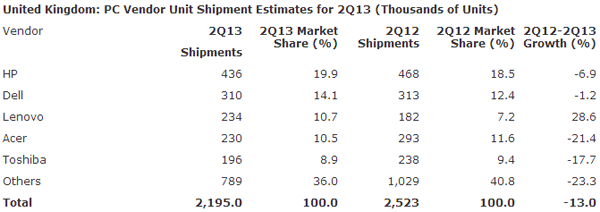

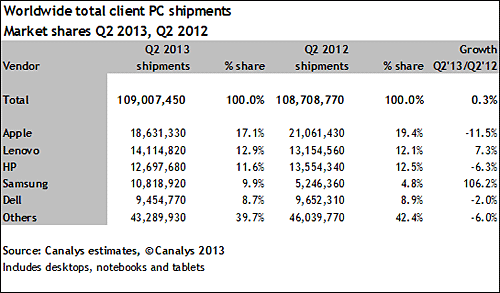

Sales across Western Europe for third quarter came in at 0.8 per cent up, year-on-year, with notebooks improving by 3.5 per cent as desktops continued to decline with a 5.9 per cent fall. The UK saw third quarter PC volume growth beat the overall Western European market, coming in at 1.2 per cent in the third quarter.

Context said there were reasons to be optimistic about the future, with Windows 10 having an impact. However, it warned that Brexit would have an impact on pricing as would the uncertainty caused by the political situation.

The business customer base was the one that kept firing with sales up by 3.3 per cent, with notebooks driving that performance.

So far Windows 10 had not had much of an impact, but Context saw some spending as a result of upgrading to run the latest Voleware. This is expected to filter through this quarter and the first half of next year.

Marie-Christine Piggott, senior analyst at Context said that there are expectations in the business space of continued, moderate growth at the end of 2016 thanks to year-end projects and Windows 10 commercial sales will also begin to pick up at the end of the year,” said.

There is little hope for the Consumer side. Customers were moving away from the traditional laptops and PCs preferring to splash out on convertibles, Chromebooks and gaming PCs.

Business customers also embraced detachable with that segment rising by 227 per cent year-on-year to go above 250,000 units through distribution.

The third quarter was great for vendors. HP which now commands a third of the units going through distribution. Asus also saw volumes increase by nine per cent to gain a 13 per cent share and Dell was also improving, Context said.